April was another positive month for equity markets, with the S&P 500 gaining 1.5% for its second consecutive monthly rise. However, mixed economic data means the outlook for the rest of the year remains uncertain.

Equity markets are pricing in a softer recession, while bond markets expect things to be worse. Inflation data is also mixed, meaning markets will be watching carefully for the impact of previous rate hikes to determine how this might pan out in the remainder of 2023.

This month, we will look at the US, UK, EU, and China individually, with a brief summary on Japan. We shall also comment on a volatile oil market over the month.

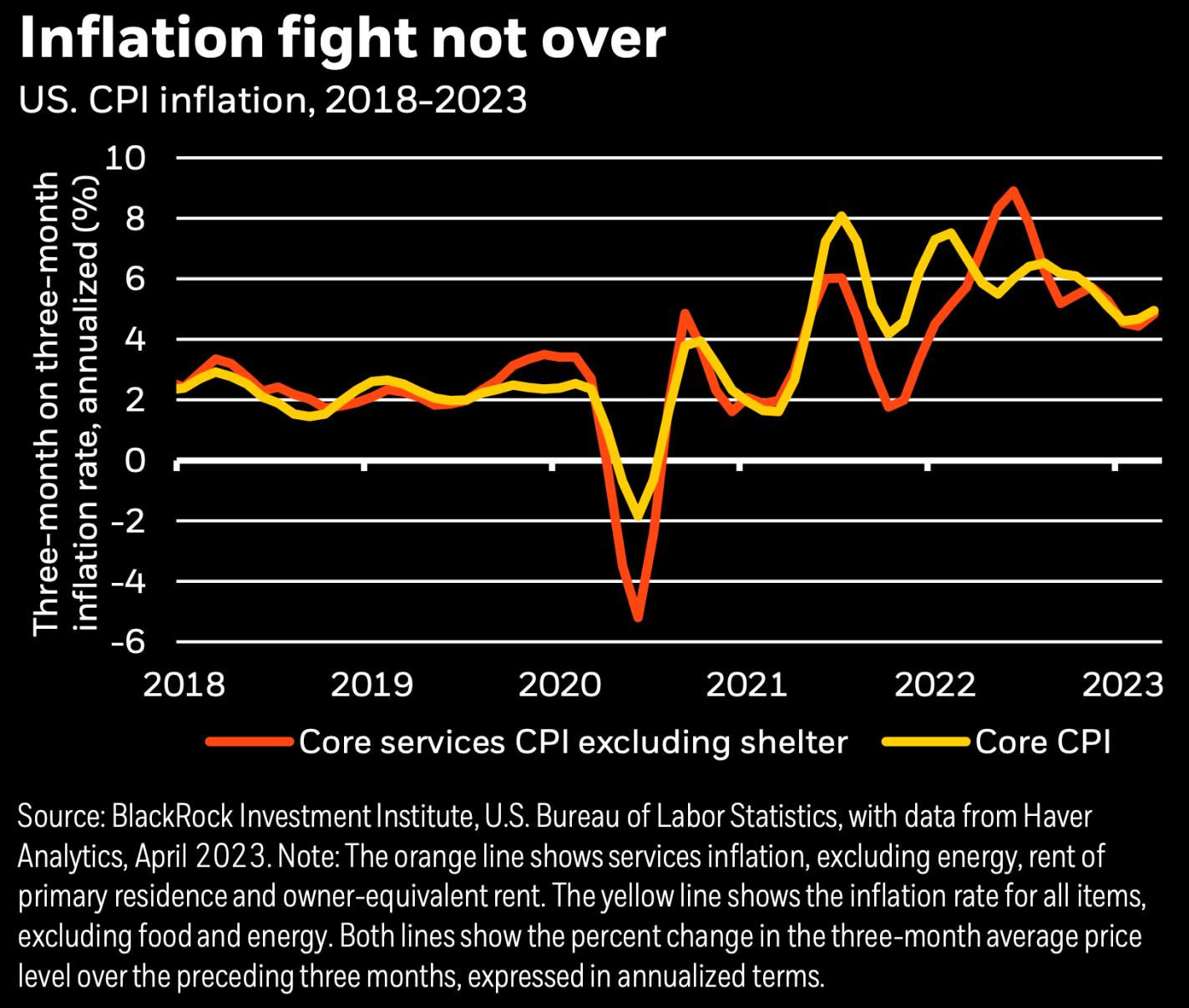

Inflation readings released for March showed that headline CPI fell sharply to 5%, its lowest level since May 2021. Whilst this is good news, there is some natural drop-off in headline inflation due to how high oil prices were 12 months ago in the immediate aftermath of the Russian invasion of Ukraine. If you take core CPI, which removes energy and food prices, it rose to 5.6% year-on-year. Whilst this was in line with expectations, it shows just how sticky inflation is in the US and how difficult it is to bring it down. Goods prices have been falling, with services prices driving much of core inflation. However, core goods inflation was back on the rise, showing just how difficult this inflationary period is and why it could still be some time before it comes back down to 2%.

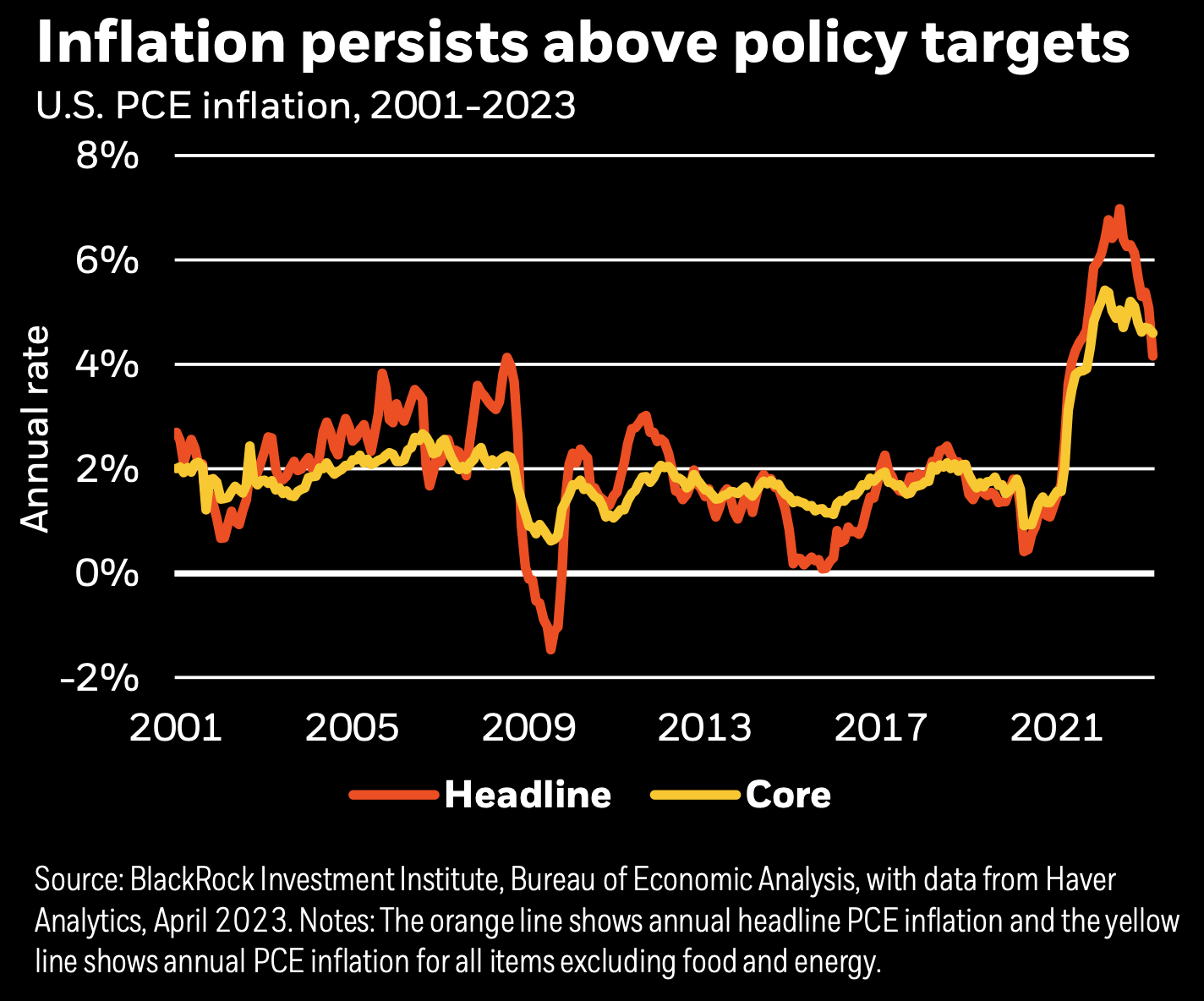

The inflation target which the Fed tends to focus on is core PCE. PCE, or the Personal Consumption Expenditures Index, has a wider scope than CPI and includes purchases made on behalf of consumers by third parties, and it tends to be lower than CPI. Again, headline PCE fell to 4.2%, but core PCE remained higher at 4.6% and is not falling as quickly.

Another inflation figure to consider is PPI, or the Producer Price Index, which measures wholesale inflation or the change in prices paid to producers of goods and services. In March, US PPI fell dramatically from 4.9% to 2.7%, which was the lowest increase since January 2021. Falling PPI rates mean that cost pressures on producers are easing, which could be a sign of easing supply chain issues or a general lower cost of acquisition of materials. This could mean that price rises passed onto end users will be less dramatic.

Alongside the inflation data, the US GDP grew just 1.1% for the first quarter of the year. This is a notable slowdown from the 2.65 growth seen in Q4 of 2022 and missed expectations by about 1%. This, along with retail sales falling, investment cuts from business, and slowing jobs growth, is giving investors confidence that the Fed has a chance of achieving its ‘soft landing’ recession.

Earnings season has begun, and around half of the companies in the S&P 500 have released their Q1 earnings reports. 80% of them beat expectations, with the average beat being 6%. Whilst cautioning for future earnings, it is a positive sign that companies have performed well.

Some commentators believe that equity markets remained overvalued, with a lot of share price performance coming from buybacks and leveraged buyouts totalling $463 billion in Q1. It could be that we have seen the best of the equity performance this year already, and we are waiting to see what happens in the real economy as the impact of previous rate hikes starts to take effect.

Finally, for the US, the fallout from the collapse of SVB is continuing for regional banks. US regulators and the FIDC are still leading negotiations for the buyout of embattled regional bank First Republic, which revealed customers had withdrawn $100 billion worth of deposits in March, causing its share price to drop a further 50% on the announcement, having already fallen 90% in March. Meanwhile, JPMorgan Chase announced that its year-on-year revenue had increased 52% following the inflow of $37 billion of deposits from SVB. Big banks seem to have been the winners in the US, with trouble potentially still ahead for some of the smaller regionals.

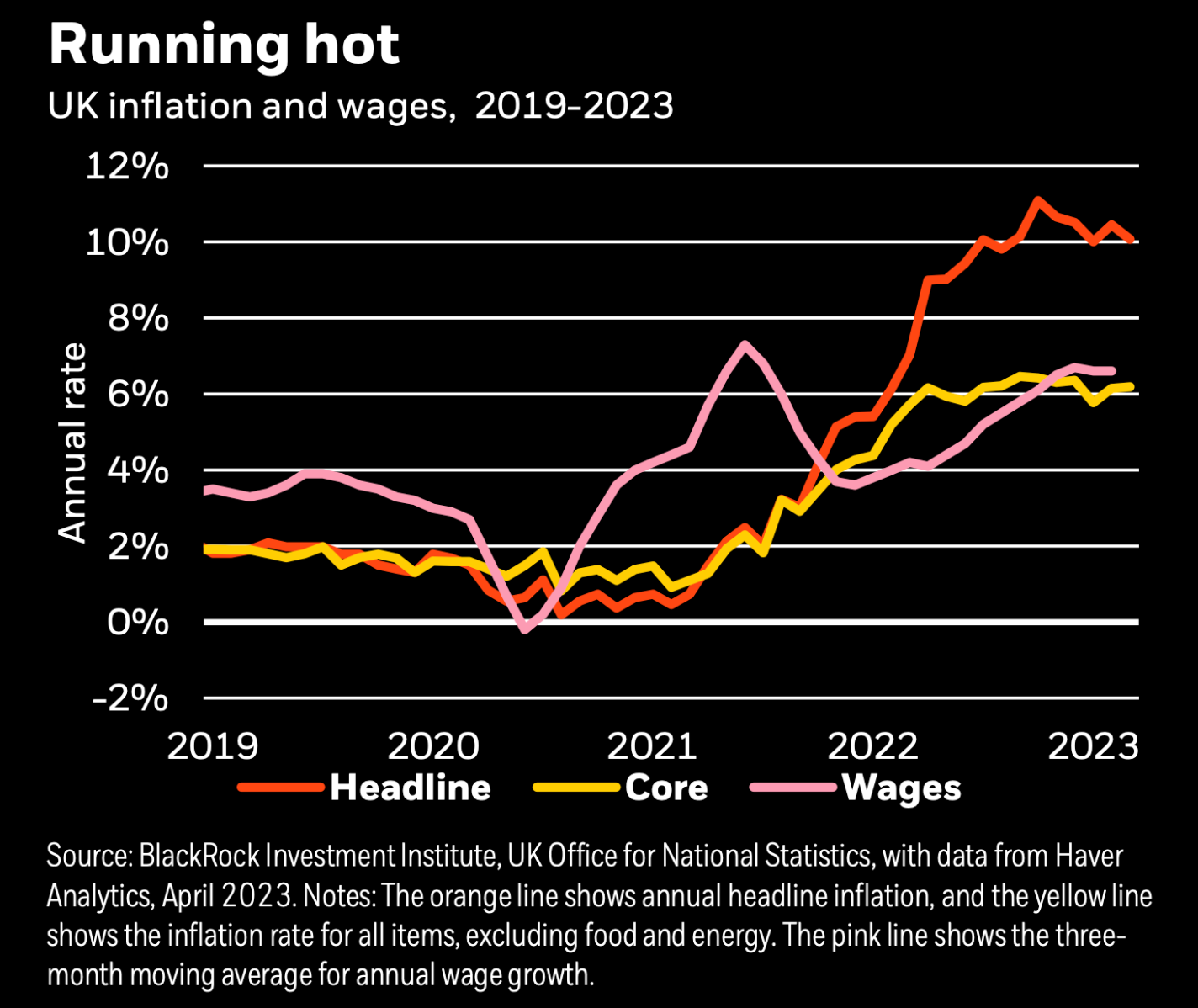

The UK remains behind the US and eurozone in its fight against inflation, with a much slower path towards its 2% target becoming apparent. March CPI remained at 10.1%, despite expectations of a fall to 9.8%. The Bank of England will likely press ahead with further 25 basis point rate hikes in both May and June, with markets now pricing a peak of 5% by the end of the year, up from the current 4.25%.

Double-digit inflation is hampering the UK consumer, with food prices reaching multi-decade highs and continuing to climb. Energy prices, whilst falling, are not easing as quickly as elsewhere. Food and energy have been large drivers of UK inflation, but even removing them, core CPI is high at 6.2% and also struggling to fall. The UK is a service sector-heavy economy, and services inflation is playing a big part in core CPI readings. Wages have also been rising quickly, particularly in the services sector, which feeds into a potential wage-price spiral for the UK economy.

Having narrowly avoided a recession at the end of last year, it is still likely that the UK could have one of the relatively deeper recessions of developed economies. The IMF has forecast GDP for the UK to shrink by 0.3% this year.

The labour supply is improving, with one of the tightest labour markets in over a generation seeing its first rise in worker supply for two years. Some older workers have been tempted back into work by the removal of the pensions Lifetime Allowance. Still, headwinds remain for the UK jobs market, such as Brexit and the number of people suffering from long-term illness.

Eurozone data doesn’t always tell the whole picture, as each country will have its own advantages or challenges during this period. Across the whole of the eurozone, data has been broadly positive, with inflation decreasing from 8.5% to 6.9% and PPI falling from 15.1% to 13.2%. European companies have also been reporting strong Q1 earnings, with similar results to the US in terms of the percentage of companies to beat expectations. An energy crisis did not take hold due to a mild winter, and manufacturing and supply chain issues have broadly been improving.

However, country by country can vary. Germany, for example, has seen its PPI fall by more than half from 15.8% to 7.5%, and its wholesale price index has collapsed by 8.9% to 2%. France, meanwhile, will be feeling the economic impact of country-wide strikes as workers protest against Emmanuel Macron’s pension age reforms (he has raised the retirement age from 62 to 64). Meanwhile, Latvia has the highest inflation rate of countries using the euro at 17.3%, and Hungary, an EU member not currently using euros, has inflation above 25%.

The ECB is expected to continue with its current rate hiking policy, stating that there is “some way to go” in getting inflation down.

On the back of swiftly ending its zero-Covid and lockdown policies in December, China saw its economy grow by 4.5% in the first quarter, comfortably beating expectations. Data for March also showed that Chinese exports rose unexpectedly for the first time in six months, climbing 14.8% year-on-year in USD terms. Easing supply chains are likely to have played a factor, but it’s too soon to say how this might continue. There could have been a catch-up in production following lockdown, and weakening global demand in the near future might start to impact China’s exports again.

Foreign direct investment into China also fell from 6.1% to 4.9%, in a potential sign that geopolitical concerns, or even China’s internal politics, could be causing some foreign investors to pause for thought.

A lot of talk on Japan has been about the Bank of Japan’s new governor, Kazuo Ueda, and if he would reverse the bank’s ultra-loose monetary policy of negative interest rates and controls on government bond yields. He has so far reiterated his commitment to sticking with this policy for now but has announced a full review of the BoJ’s historical monetary policy, which will take place during the next 12 to 18 months.

This comes at an interesting and challenging time for the Japanese economy, which is now experiencing historically high inflation. CPI has fallen from 3.3% to 3.2%, but with Japan having seen decades of low growth and a deflationary environment, this is historically high for the country. While most central banks focus on core inflation, the BoJ focuses on ‘core-core’ inflation, excluding fresh food and energy (as opposed to ex-food and energy). This rose from 3.5% to 3.8%, which is the highest since records began in 1981. The new governor faces a challenge to help turn this around.

Oil prices surged at the start of April following OPEC+’s surprise announcement of a cut in production, having originally said they wanted to keep production steady in 2023. Output has been lowered by 1.15 million barrels per day, which will reduce supply by the equivalent of 3.7% of global demand. OPEC+ said the cuts were to support market stability and deter speculators betting on lower prices. The first two weeks of April saw oil prices rise by 5% and 2.5%, respectively.

However, oil collapsed again at the end of the month, with the benchmark Brent crude falling below $80 per barrel, as markets became more concerned about a global economic slowdown and a potential recession in the US.

Taiwan announced a recession, with a 3.02% decline in GDP for Q1, following a smaller negative move in Q4. Q1’s reading was the worst for Taiwan since the Global Financial Crisis.

Tech company earnings report nearly all mentioned AI as a key talking point, with optimism that they could successfully implement AI tools and profit from them.

The UK’s Competition and Market Authority blocked Microsoft’s $69 billion purchase of Activision Blizzard, the maker of games such as Call of Duty and Fortnite. The CMA was then accused by those involved in the deal of being anti-competitive and discouraging technological innovation.

The Australian central bank held interest rates following ten consecutive rate hikes. The Reserve Bank of India followed suit, holding its benchmark rate at 6.25% against expectations of a further 0.25% hike.

Virgin Orbit filed for bankruptcy protection in the US.

China Renaissance Holdings, an investment bank in Beijing, suspended trading in its shares and postponed its audited annual results because auditors could not contact the firm’s chairman. It is assumed he has been detained by authorities and cooperating with an investigation.

Chinese insurer Ping An, which owns 8% of HSBC, increased pressure on the bank to carve off its Asian business.

Apple opened its first Indian stores in Mumbai and Delhi. Apple CEO Tim Cook met Prime Minister Narendra Modi as Apple expanded its manufacturing base in the country.

UK coffee and sandwich shop chain Pret A Manger also opened its first store in Mumbai’s financial district.

To learn more about which strategy works best in your portfolio to meet your objectives, please speak to your Financial Planner.