In September, global stock markets declined for the second consecutive month as investors assessed mixed economic data and the ongoing “higher for longer” stance on interest rates from Central Banks.

Bond markets also faced challenges, with US treasuries reaching pre-global financial crisis yield levels. Traditionally, August and September are the weakest months in a calendar year, and even if there’s a fourth-quarter recovery, it’s likely that we’ve already witnessed the year’s peak growth. Markets are adjusting their expectations for future interest rates, with rate cuts not anticipated until late next year.

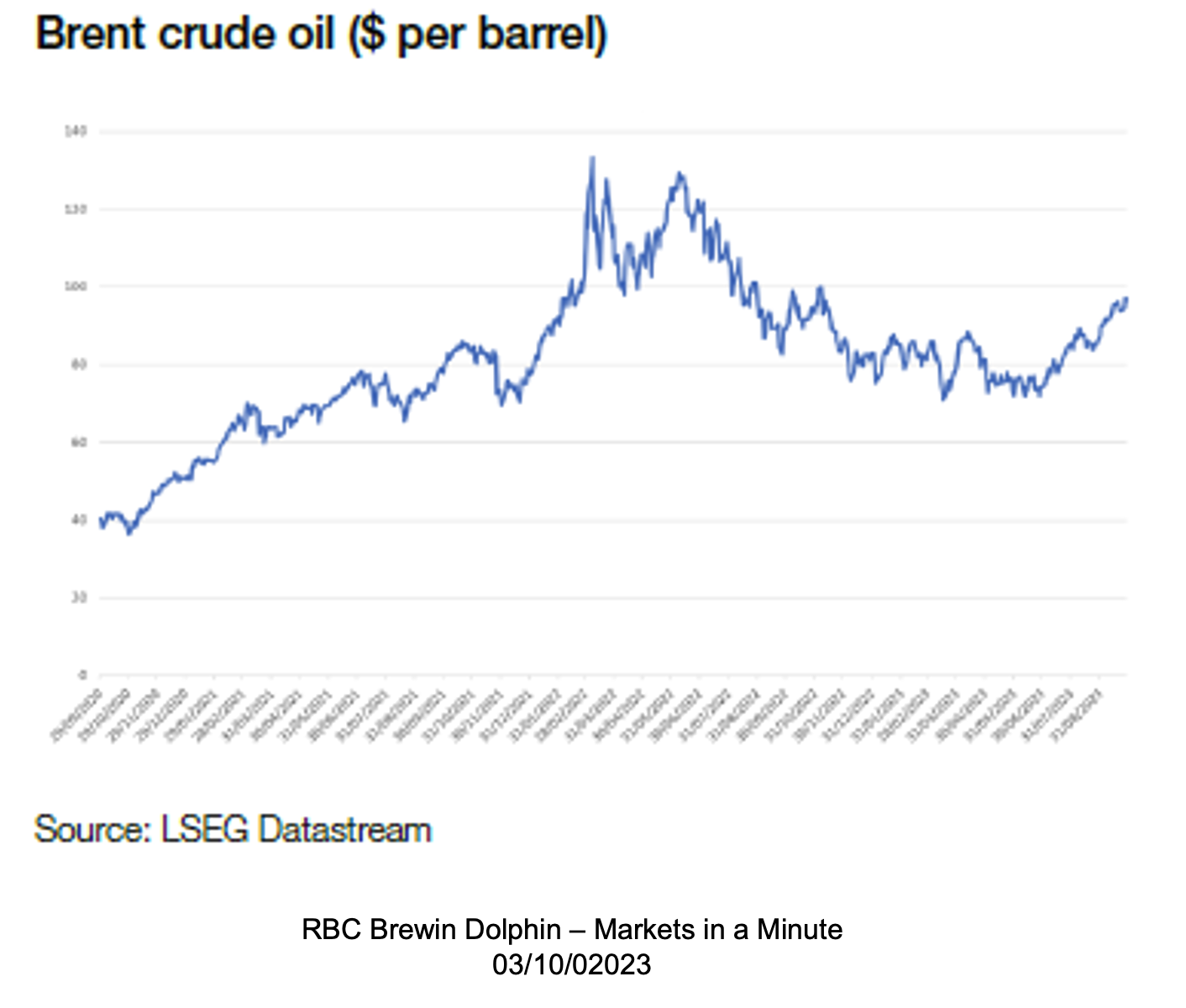

Energy markets remained volatile, with Brent crude oil rising back toward $100 per barrel from earlier year levels in the mid-$70s. Furthermore, there was significant news in the renewable energy sector to digest during the month.

Brent crude continued its volatile year. Saudi Arabia and Russia extended their voluntary oil production cuts to the end of the year rather than October despite expectations of an already tight supply through Q4. Shale output in the US also declined, limiting the US’s ability to offset the Saudi and Russian cuts. Brent crude exceeded $90 per barrel for the first time since November 2022 and approached $100 per barrel by month-end. Saudi Arabia defended its decision, citing economic uncertainties like reduced demand from China despite the risk of a supply shortfall.

In Australia, workers at Chevron’s LNG projects went on strike, potentially disrupting global gas supplies. These two facilities account for 7% of global supply, and European gas prices surged by 12% following the strikes due to Europe’s heavy reliance on overseas supply following sanctions on Russia. A deal between Chevron and Offshore Alliance, the workers’ union, ended the strikes and helped stabilise prices.

No energy companies submitted bids for the UK government’s offshore wind auction. There had been warnings prior to the auction that the subsidies on offer were too low, especially given the soaring costs of building wind power infrastructure. Overall, a record number of renewable projects were awarded funding, according to the government, but private investment into the UK’s wind sector is falling short due to the economics not being currently viable.

Prime Minister Rishi Sunak delayed the ban on new petrol and diesel cars from 2030 to 2035 whilst insisting the UK was sticking to its net-zero commitment. This move faced widespread scepticism, even within the motor industry, as many manufacturers had already invested in electric vehicle production to meet the 2030 target. Changing government policies and unmet promises have eroded confidence in investing in the UK for many businesses.

In other renewable energy news, Singapore aims to scale up a pilot project to extract CO2 from seawater to enhance the ocean’s carbon dioxide absorption capacity. Germany is on track to generate 50% of its energy from renewable sources this year and is working to accelerate the transition to an 80% green energy production target by 2030.

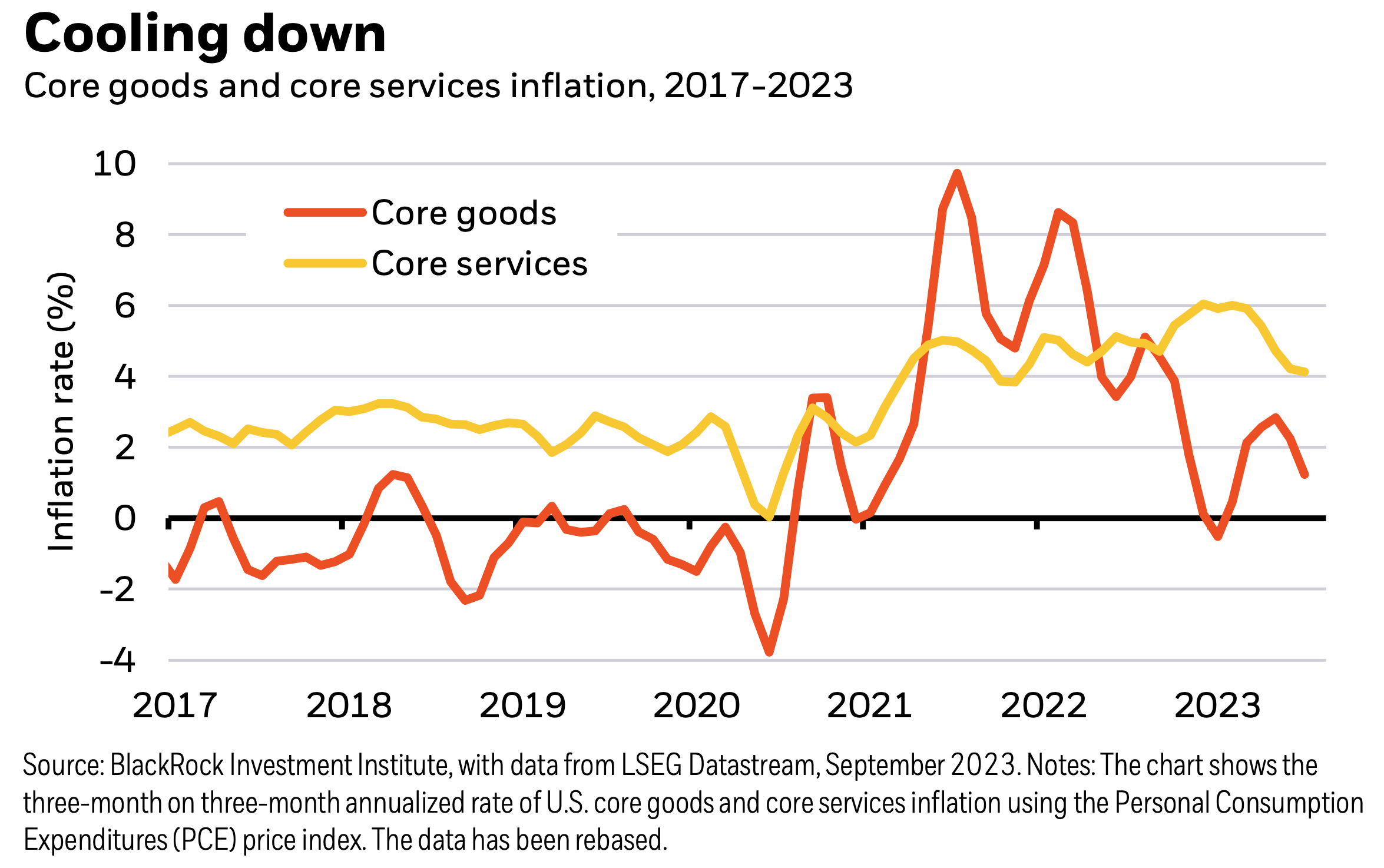

In August, annual inflation rose to 3.7%, marking the second consecutive monthly increase, with higher energy prices contributing to over half of the uptick. Meanwhile, core inflation dipped to 4.3%. The Federal Reserve held interest rates steady at 5.25% to 5.5% but signalled the possibility of a rate hike later in the year due to the inflation data and a stronger-than-expected US economy.

The services sector has seen significant growth in the past six months, but services inflation has cooled as wage growth eased. Goods inflation is notably lower compared to 2022. Services inflation now holds a larger share of the headline figure, reflecting the economy’s recovery from the pandemic’s impact.

The prevailing “higher for longer” narrative continued to dominate markets in September, resulting in the S&P 500 index’s second consecutive monthly decline, down 4.9% for the month and 3.7% for the third quarter. Bond markets also felt the impact, with shifts along the yield curve, including two-year treasuries reaching their highest yield since 2006 and ten-year treasuries hitting their highest since 2007. Initial expectations for a one-percentage-point rate cut in early 2023 have diminished, with markets now pricing in only half a percentage point and the first cut potentially occurring at the end of next year.

The US narrowly avoided another government shutdown with a bipartisan funding deal signed by President Biden just minutes before the midnight deadline. This agreement funds the government for an additional 45 days until November 17th. Military aid for Ukraine was a contentious issue left out of the current deal. While the 45-day window allows for further negotiations on longer-term funding, challenges may arise, particularly from hardline Republicans displeased with Kevin McCarthy, the (now former) Speaker of the House, striking a deal with Democrats. It’s worth noting that government shutdowns in the US are relatively common, and financial markets typically do not have a prolonged negative reaction to them.

The ECB raised rates to an all-time high since introducing the euro, setting the base rate at 4%. ECB President Christine Lagarde suggested that this rate if maintained for an extended period, might serve as the terminal rate aimed at bringing inflation back to target.

Eurozone inflation dipped to 4.3%, its lowest level since October 2021.

Additionally, European government bond yields climbed after Italy revealed a larger-than-expected fiscal deficit, triggering a bond sell-off.

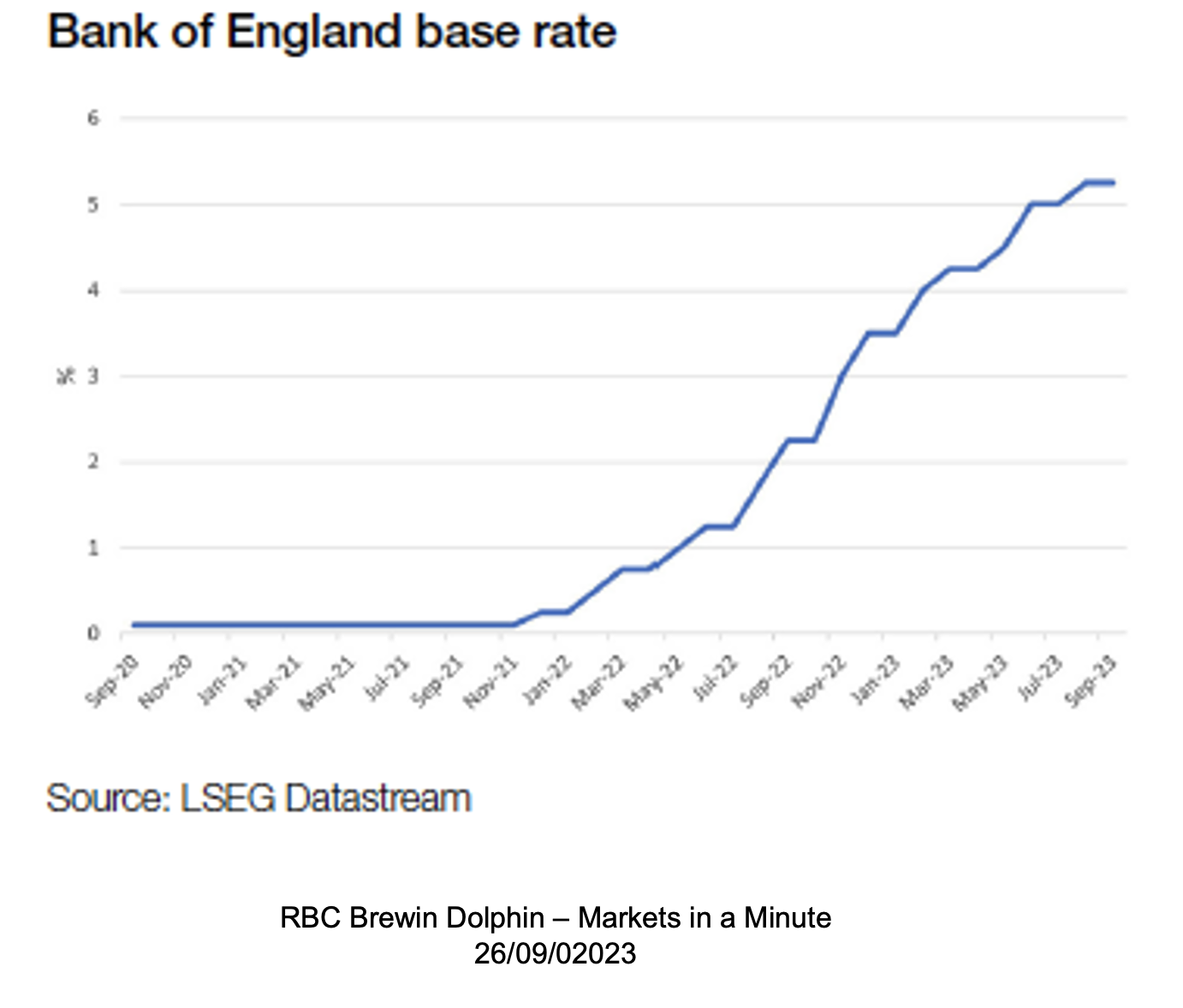

The Bank of England paused its rate hikes due to an unexpected 0.5% contraction in the UK economy in June, influenced by strikes and adverse weather conditions. Recent data suggests a more significant economic weakening than the Bank of England had previously anticipated. By a narrow 5-4 vote, the Bank decided to maintain its base rate at 5.25%. This marked the first time since the end of 2021 that interest rates did not increase. Governor Andrew Bailey emphasised that the fight against inflation wasn’t over, and rates could rise again if necessary.

UK annual inflation dropped to 6.7% in August, surprising expectations of a rise to 7%. Despite a 30% oil price increase, domestic disinflation brought the headline figure down to its lowest point since February 2022. Core inflation also saw a substantial drop to 6.2%, a significant decrease from July’s 6.9% and well below the expected 6.8%.

In another sign of waning investor confidence in the UK, chip maker Arm had chosen to list on the NASDAQ over the LSE and made a successful debut this month. The IPO resulted in a 25% increase in share prices, pushing the market cap to approximately $65 billion.

China’s exports extended their decline for the fourth consecutive month in August, plummeting by 8.8% year-on-year, primarily due to weak domestic and foreign demand. Exports to the EU saw a nearly 20% drop, and US exports fell for the 13th consecutive month. Simultaneously, China’s imports also decreased by 7.3% year-on-year in August.

Property developer Country Garden managed to meet two interest payments to bondholders just before the end of a 30-day grace period, averting a technical default. On the other hand, a subsidiary of Evergrande, Hengda Real Estate, came under investigation, preventing Evergrande from issuing new notes as part of its debt restructuring plan. Consequently, Hengda missed a 4 billion yuan bond payment.

The Asian Development Bank revised China’s growth forecast downward to 4.9% from 5%, citing the property crisis and climate-related risks as contributing factors.