October saw another decline in global markets as the “higher for longer narrative” sank in with investors, bond yields surged, and a new war broke out in Israel and Palestine.

The MSCI World Index dropped a further 3%, extending its slump to three consecutive monthly declines since August. Undoubtedly, the latest conflict between Israel and Palestine has weighed on global markets over fears it could spark a wider war across the Middle East.

This month, we will review the latest news on inflation and interest rates and explain how the recent market falls create opportunities for investors in both traditional and alternative asset classes.

Oil prices experienced a significant uptick with the onset of the Israel-Palestine conflict. The concern stemmed from the potential disruption in the production and transportation of oil. This, in turn, had a ripple effect on gas prices in Europe, as Israel plays a pivotal role as both a producer and regional exporter. To compensate for the absence of Russian gas – which ceased flowing into Europe following the beginning of the war in Ukraine – discussions revolved around establishing new routes for exporting Israeli gas to the continent. Simultaneously, the conflict triggered unease in stock markets, as there were apprehensions that it might escalate into a broader war in the Middle East.

In contrast, gold, a long-standing haven asset, saw a notable price increase, surging from $1,830 per ounce on October 7th to over $2,000 per ounce by the end of the month.

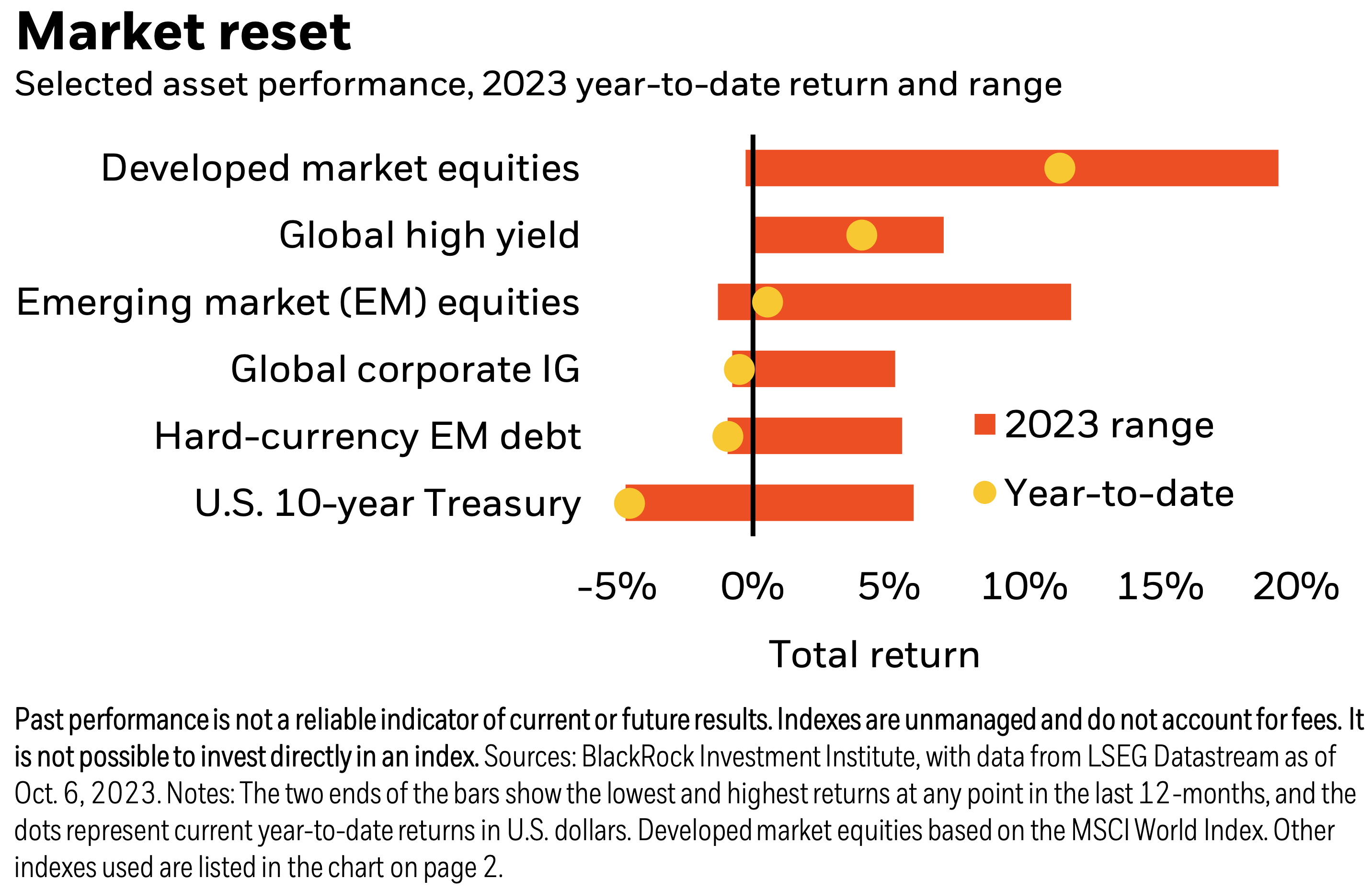

Yields on 30-year US treasuries crossed the 5% mark for the first time since 2007, a consequence of the Federal Reserve’s ‘higher for longer’ approach impacting both the bond and equity markets. The 10-year treasury yield briefly reached 5%, and 30-year fixed mortgage rates surged past 8%, their highest level since 2000. The anticipation of prolonged high-interest rates, coupled with concerns about the US’s fiscal situation (a 23% increase in the federal government deficit over the past year to $1.7 trillion, with total debt standing at $33.6 trillion), is weighing on global markets. Notably, the rise in US treasury yields is affecting emerging market debt, a significant portion of which is denominated in US dollars. However, higher bond yields might mean less need for further interest rate hikes.

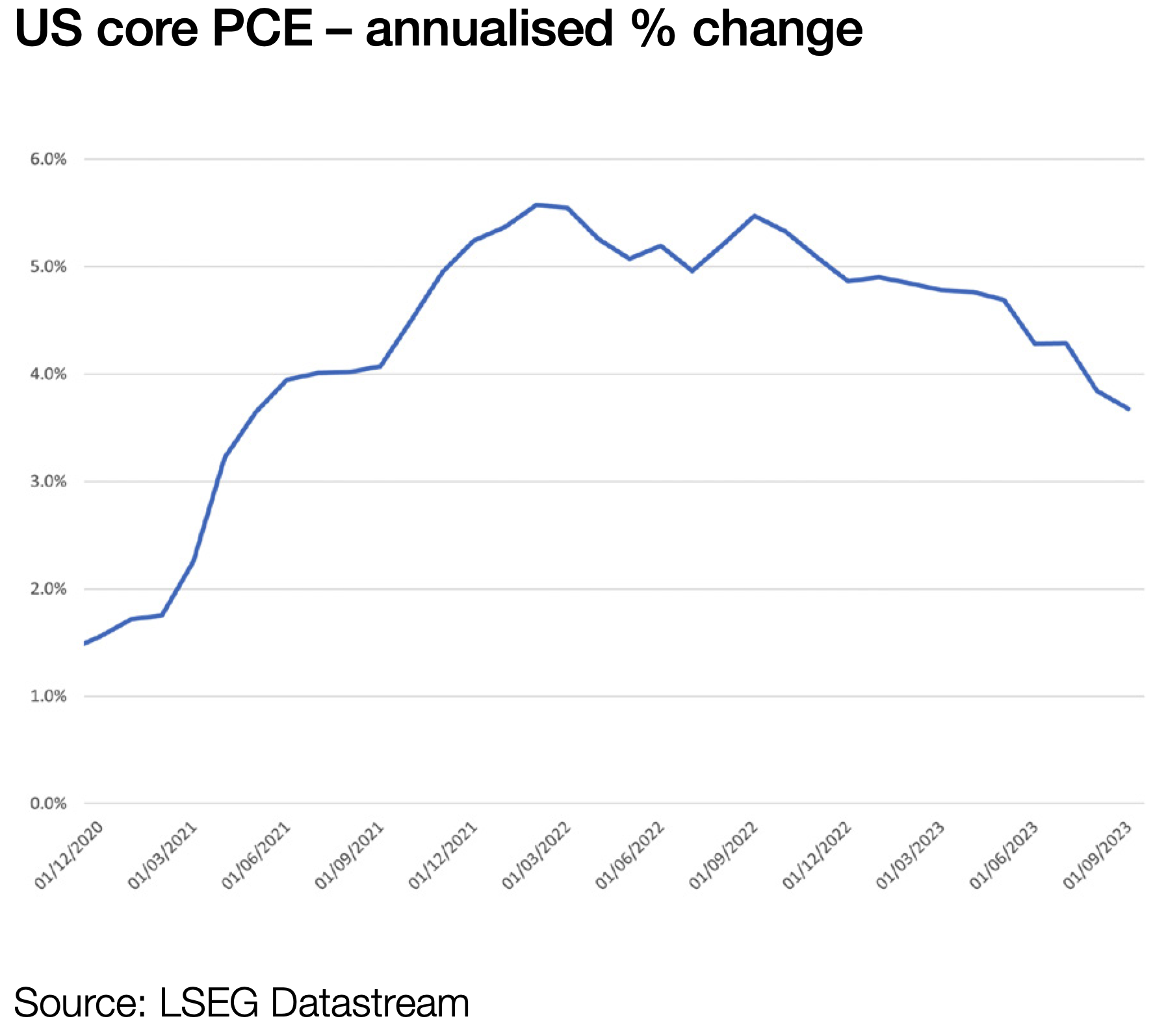

In September, the US Consumer Price Index (CPI) saw a 0.4% month-on-month increase, surpassing expectations and pushing the annual inflation rate to 3.7%. A significant portion of this increase is attributed to rising rent prices. Core CPI, which excludes volatile food and energy prices, experienced a 0.3% increase in September, marking its smallest rise in two years, and its annual rate of 4.1% was the lowest since September 2021.

The Federal Reserve’s preferred gauge of inflation, the core Personal Consumption Expenditures (PCE) price index, eased to a four-month low of 3.7% year-on-year.

September witnessed a higher-than-expected increase of 336,000 jobs, the most significant gain since January, led by the education, hospitality, and health sectors. However, wage growth slowed, with hourly wages rising at the slowest monthly pace since early 2022 and annual earnings growth at the slowest rate since mid-2021.

Additionally, the US economy outperformed expectations in Q3, experiencing its fastest growth in two years with an annualised GDP increase of 4.9%.

The UK economy grew by 0.2% in August from July. This was in line with expectations, although services sector growth was stronger than anticipated, with the manufacturing and construction sectors seeing declines. Overall, the wider picture for the UK remains one of sluggish growth amidst 14 consecutive interest rate hikes and three years of economic headwinds.

In September, the UK’s Consumer Price Index (CPI) remained the highest among advanced economies, holding steady at 6.7%. This was influenced by rising petrol prices. Even when excluding the fuel price increase, core inflation, while easing to 6.1%, and robust services prices make it challenging for the Bank of England to rule out further interest rate hikes, causing gilt prices to fall.

Annual pay, excluding bonuses, witnessed a notable increase of 7.8% in the three months leading to August, marking the first time in nearly two years that wage growth has surpassed inflation in the UK. However, the concurrent job data for the same period revealed an uptick in unemployment from 4% to 4.2% between March and May. This suggests that inflation and high-interest rates are impacting businesses, leading to reduced hiring, and could indicate that high-interest rates are beginning to have the intended effect. Consequently, market expectations lean toward the Bank of England maintaining its base rate at 5.25% in its upcoming November Monetary Policy Committee meeting.

The European Central Bank (ECB) maintained its benchmark rate at 4%, halting its fastest series of increases since the euro’s introduction. Eurozone inflation, while still above the Bank’s 2% target, is showing signs of easing. Annualised Consumer Price Index (CPI) dropped to 4.3% in September from 5.2% in August, and core CPI decreased to 4.5% from 5.3%.

Yields on Germany’s ten-year bonds surged to over 3% for the first time in 12 years. The country also slashed its economic growth forecast for the year, now anticipating a 0.4% contraction instead of any growth.

In Q3, China’s GDP expanded by 4.9%, surpassing the expected 4.6%. Earlier in the year, China implemented measures to bolster its economy in response to slow growth, and recent data indicates that these efforts may be yielding results. Nonetheless, ongoing challenges in the property sector warrant caution as the Chinese economy continues to grapple with several headwinds.

In October, Tokyo’s core CPI, which excludes fresh food but includes fuel, unexpectedly rose to 2.7% year-on-year, marking the first inflation increase in four months. Core CPI, excluding fuel, stood at 3.8% year-on-year, slightly lower than the 3.9% reported for September, and headline inflation increased to 3.3% from 2.8% in September.

The possibility of the Bank of Japan raising interest rates led to Japanese bond yields reaching their highest level in a decade. Consequently, the central bank had to conduct unscheduled purchases of government debt to uphold its yield control policy.

We consistently advise our clients that market downturns present opportunities. For investors who regularly contribute to the market, this is a chance to leverage dollar-cost averaging, acquiring more units as the market declines. This strategy pays off in the long term when markets rebound. Even for lump sum investors, the current market downturn offers a favourable entry point. If you considered investing when markets were bullish earlier this year, now is an even more attractive opportunity.

In the realm of alternative assets, we’re identifying numerous prospects. Alternative assets encompass non-traditional investments like real estate, commodities, hedge funds, venture capital, and more. Given the impact of high-interest rates on bond and equity prices, diversifying away from these two asset classes is paramount. While they hold their place in long-term portfolios, introducing uncorrelated returns through alternative assets offers distinct advantages.

In recent years, bonds have failed to provide the defensive element they typically offer to a portfolio. It has been half a century since bonds and equities exhibited a downside correlation. In these exceptional times, the inclusion of alternative assets is more vital than ever. Consult your Financial Planner to explore how you can integrate alternative assets into your portfolio, positioning your investments optimally for the present and the future.