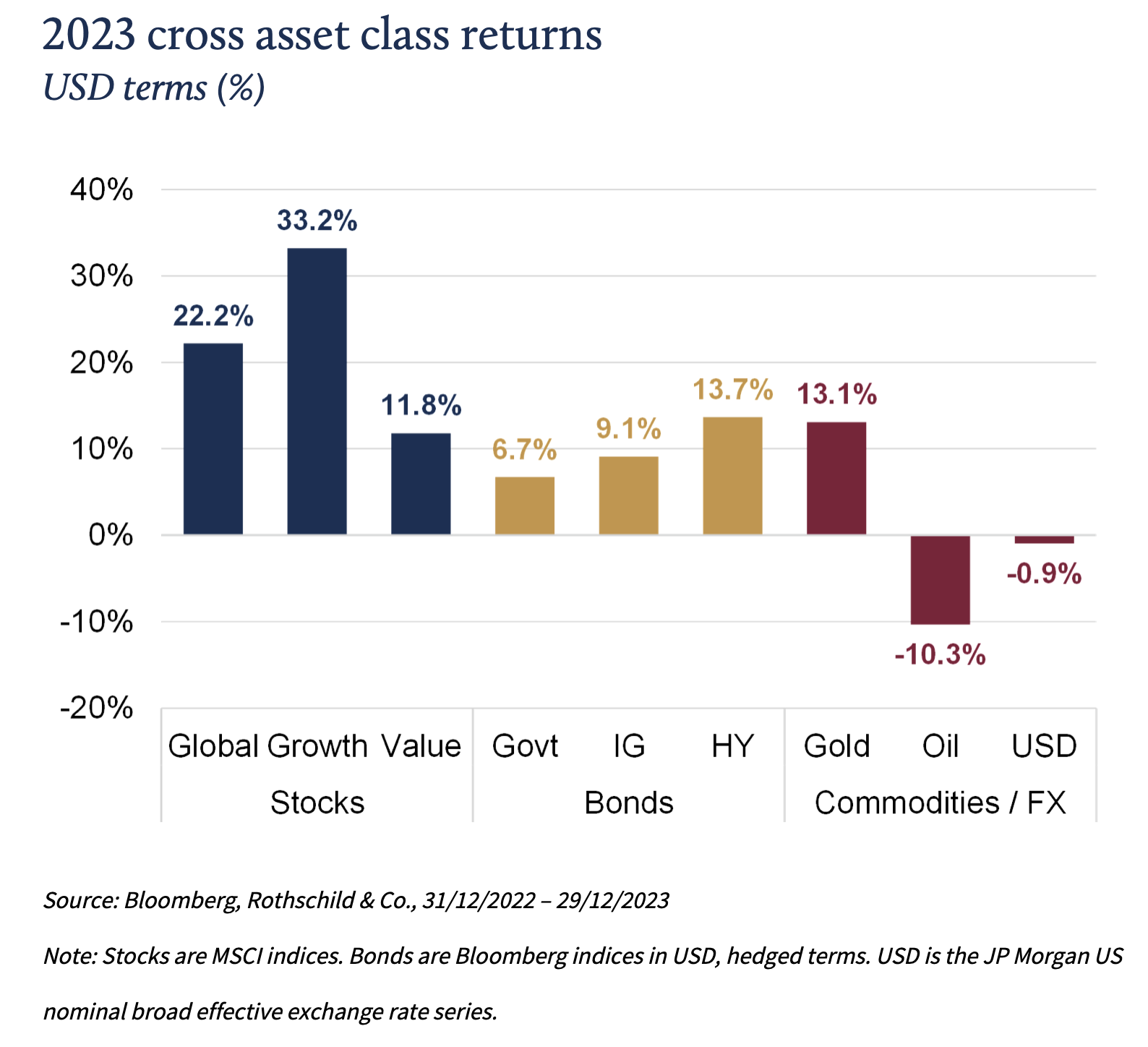

December saw a strong end to the year, with all sectors up and the MSCI World Index finishing with a 22.2% gain in US dollar terms. The Nasdaq 100 index, mainly composed of tech companies, recorded a 55% gain to close the year at a record high.

Bond markets staged their best two-month rally on record to also finish the year in positive territory.

This month’s update looks at the latest Central Bank rhetoric on interest rates, which helped drive the year-end rally and market performance overall in 2023.

Major central banks left their benchmark rates unchanged in December. Following the third consecutive decision not to move rates, chair of the Fed, Jay Powell, said that they had “done enough” on rate hikes and set out a timetable for potential rate cuts during 2024. The latest projections showed a possible three cuts in the new year, which is more than the market consensus of two cuts anticipated before the meeting. With inflation slowing only slightly to 3.1% in November and core inflation remaining at 4%, markets took this to mean that the 2% inflation target may not need to be met before rates are cut.

The Bank of England also kept its benchmark rate unchanged. However, there was a difference in message from Andrew Bailey, the Bank’s Governor, who said there was “still some way to go” in fighting inflation and that interest rates would remain high for an extended period. The Bank’s position assumes that the headline rate will slowly decline from 5.25% now to 4.25% in three years’ time, despite market sentiment that rates should drop to that level by the end of 2024. This is more bad news for the UK, whose economy shrunk in October against expectations of it remaining flat, adding to the likelihood of a recession at some point during the year.

The ECB took a similar stance of pushing back against the idea of any imminent cuts, despite the latest inflation figure of 2.4% being very close to the Bank’s target of 2%. The ECB rate remains at a record high of 4%, with President Christine Lagarde stating that there is “still work to be done” and reaffirming that the Bank intends to keep rates high for a while.

China’s economic slowdown prompted Moody’s to downgrade its outlook on Chinese government debt from stable to negative. The ratings agency cites economic and fiscal strength risks due to support for local government and state-owned enterprises. They anticipate a slowdown in annual GDP to 4% in 2024 and 2025, averaging 3.8% from 2026 to 2030. Despite this, Moody’s maintains an A1 rating for China’s long-term national debt.

Contrary to China’s claim of economic recovery, recent data paints a different picture. Consumer prices declined 0.5% year-on-year and month-on-month in November, while producer prices continued to deflate, falling 3% year-on-year for the 14th consecutive monthly decline. Government pro-growth measures have yet to revive the economy. Although 5% growth for the year seems positive, it’s crucial to note that China was still in lockdown at the end of 2022, making 5% growth from lockdown less impressive.

COP 28 in Dubai concluded with an agreement to “transition away from fossil fuels in energy systems in a just, orderly, and equitable manner.” This fell short of the desired consensus, particularly in the West, where there was an expectation for commitments to “phase out” fossil fuels. However, the deal does include global targets to triple renewable energy capacity and double energy efficiency improvements by 2023.

China initiated commercial operations in one of its first “fourth generation” nuclear power plants, adding 37 nuclear reactors to its energy mix over the past decade (compared to two for the US) and aiming for eight installations annually moving forward.

The International Energy Agency reported a drastic slowdown in global oil demand growth, attributing it to higher interest rates and sluggish economic activity in Europe and the Middle East.

——————————————————————————————————————————————————–

2023 was positive for markets, with a strong rebound in equities all but reversing the losses we saw in 2022. We experienced a couple of rough patches during the year, notably in February and the first half of March when the collapse of SVB led to fears of a wider banking crisis, and August through October when markets began to reassess mixed economic data and come to terms with the “higher for longer” message on interest rates coming from Central Banks. As these two periods show, being invested for the long-term and not being overly concerned with the short-term noise is beneficial. By not panicking during these periods, those who invested early on this year have seen strong returns. This is especially true of the longer downturn when November and December bounced back exceptionally strongly.

The long-term mindset has also served well those investors who did not panic during 2022. At the time, it felt painful to see market declines across the board. But one year is not a long time in investing, and we have seen from 2023 how quickly markets can recover. That is not to say that there are no more headwinds – inflation remains above central bank targets, interest rates are still high, certain economies may slow more than others, etc. – but it highlights why staying the course is important. It also shows why it’s crucial to take advantage of a market that has fallen and invest further or invest on a more regular and consistent basis to benefit from dollar cost averaging.

Even bond markets finally recovered in the year’s final months after experiencing further bad times for most of 2023. Higher interest rates have had a negative impact on bond prices for quite a while, but hopes of cuts on the horizon and inflation coming under control have eased these worries and created opportunities to buy back into bond markets. Gold also had a strong year, giving double-digit returns as investors looked to this safe-haven asset during the turbulent times of the past 12 months. In fact, oil was the only major asset class to fall in 2023, following it being the only one to rise in 2022, as global demand fell on recession fears and the much-anticipated reopening of China failing to deliver the economic boost that many had expected. The US dollar also fell slightly compared to other currencies as it reached peak interest rates, and rate cuts are expected sooner than on other currencies.

Interestingly, the performance of some indices is being driven by a handful of large companies. Taking out Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta from the MSCI All-Country World Index dramatically reduces how much this has grown. So, whilst we can say that markets have recovered strongly, there is more nuance to it than simple growth across all stocks. This is why it’s essential to maintain a well-diversified portfolio, with managers who can actively choose a concentrated portfolio of stocks with strong metrics to give a good chance of outperformance. With the MSCI index less the seven companies named above growing 12% in 2023, we can see that, although 12% is a healthy return, it is possible to outperform by taking the best companies from the index (or even outside it) and investing in them. This doesn’t mean we look for managers investing just in these seven companies; more diversification is needed. However, we are happy with those active managers we use to complement a smaller weighting towards index tracking.

We also don’t try to second-guess which markets will perform best in a given year. For example, last year’s top three countries for equities growth (in USD terms) were Hungary, Poland, and Egypt. If we had advised on buying Hungarian equities in January 2023, it’s unlikely that anyone would have believed it to be the best option. We, of course, would also not have been able to say with any certainty that this was a good idea. Similarly, we cannot say where the best place to invest in 2024 will be. This is another reason why we stick to long-term strategies and work alongside some of the best fund managers in the world to generate returns for our clients.

The last two years have taught us and our clients some valuable lessons. Long-term thinking is essential for any investor, especially during volatile times and extended periods of downturn. We all know that buying low is the ideal, but when your investment is declining in value and emotions factor into decision making, it becomes harder to remember this important tenet. Dollar cost averaging by investing monthly can ease this somewhat, but the rebound of 2023 has shown that markets do recover. Anyone who invested early this year has seen the rewards so far.

We have also learnt the importance of wider diversification by introducing alternative asset classes into portfolios. We believe that the traditional 60/40 balanced portfolio of stocks and bonds is no longer fit for purpose. We do not believe that it is ‘dead’, as many would say, but rather that the recent closer correlation between stocks and bonds and increased volatility in bonds, which are supposed to provide a defensive element, has shown the need for alternatives. We have used long/short equity funds in the absolute return space, hedge funds using algorithms and AI to produce well-above-market returns, venture capital funds investing in fast-growing private companies with huge potential, and loan notes providing high rates of fixed income, amongst other options, to truly diversify our clients’ portfolios and give them the best chance of achieving solid returns over the long-term with reduced volatility.

To summarise, 2023 was a very good year for investors, and we wait on the interest rate picture further in 2024, particularly for cuts in the US, to see if the good performance continues.

Your Financial Planner is available to review your portfolio performance last year in more detail and discuss how you may wish to add alternative assets to your portfolio to improve its performance potential further.