Uncertainty remains around US tariff policy and its impact on markets, plus President Trump’s spending bill is expected to increase the US debt even further, leading to a credit rating downgrade for the country.

This month, we look at the latest developments on tariffs, as well as the US credit rating downgrade.

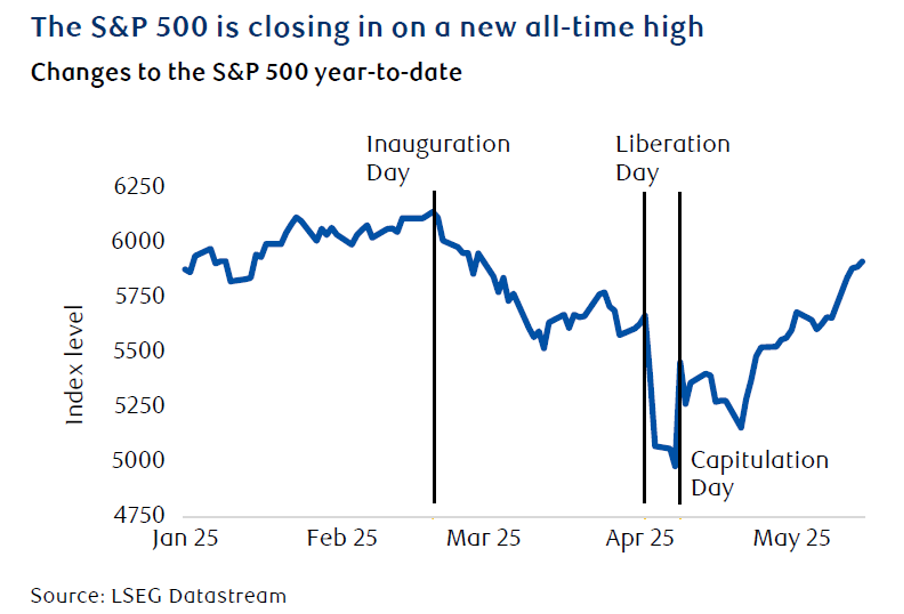

Despite the uncertainty and some volatility, equity markets had a good month in May as the post-‘Liberation Day’ rebound continued.

America and China agreed to cut tariffs for a period of 90 days whilst further negotiations took place. While the US is targeting everyone with tariffs, China is the one facing the biggest penalties, so what happens between these two nations will be a significant area to watch. So far, US inflation has not been impacted by the tariffs; in fact, it dropped to 2.3% in April from 2.4% in March, but retailers are preparing to increase their prices due to the additional import costs that are coming, with Walmart saying that tariffs on China remain “too high”, despite the pullback. Talks with China have not been progressing well, with both sides accusing each other of stalling or failing to follow through on non-tariff-related rollbacks.

Most economists believe that, in the long run, tariffs will hurt US consumers and the US economy. However, so far, the US has seen a record $16.3 billion in receipts from customs duties in April, more than double the $7.1 billion in April 2024.

Trump said that negotiations on trade with the EU were “going nowhere” and that he would introduce a blanket 50% tariff on the bloc. The EU is one of the US’s largest trading partners, with hundreds of billions of dollars worth of goods traded between the two. Trump also stated that he would impose a 25% tariff on iPhones manufactured outside the US, aiming to pressure Apple to relocate production away from China. Apple has announced that it expects to incur $900 million in additional costs due to tariffs.

There are also plans to double the tariffs on imports of steel and aluminium to 50% in order to protect the US steel industry.

There is now an ongoing battle between the Trump administration and the US courts on the President’s authority to impose sweeping tariffs. The US Court of International Trade ruled that the administration did not have the power to impose tariffs under the economic emergency law, which it had used as the justification for the tariffs. The Court determined that Congress has the exclusive power to regulate commerce with other nations and that this power is not superseded by the President’s remit to safeguard the economy. The administration appealed the decision and, under the conditions of the appeal, is allowed to continue pursuing its tariff policy pending a final decision.

Trump is unhappy at the courts attempting to derail one of his signature policies, and this court battle could rumble on for a while.

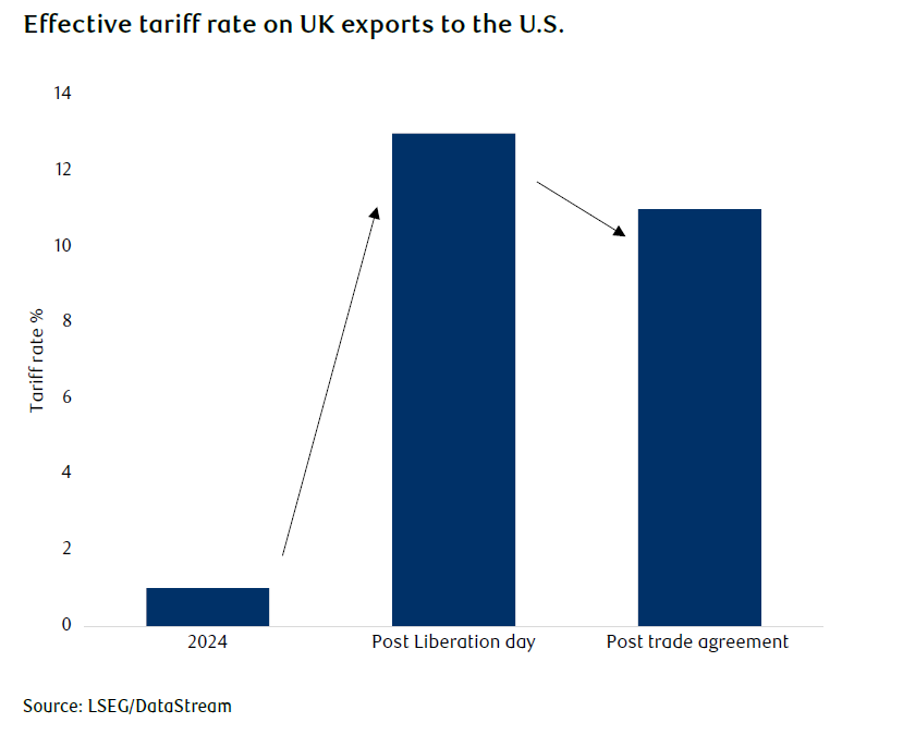

The US and the UK have agreed on a trade deal, although the details are still to be finalised. The deal amounts to an amendment to US tariffs rather than a full and comprehensive free trade agreement. The UK may receive a partial or full exemption from tariffs on its steel exports, which would be particularly important given the significance of the steel industry to the UK government. UK steel is typically used in the US for things such as nuclear submarines, where it has better properties for the project than the steel that can be produced in the US.

Ultimately, the trade deal may not have a significant impact, as the UK will still be subject to the universal 10% tariff imposed by the US.

The biggest news of the month for the market was the downgrading of the US credit score by the rating agency Moody’s, who removed the country’s AAA rating due to concerns over mounting debt. Moody’s now rates the USA as Aa1, becoming the last of the three major credit rating agencies to remove its top rating from the US. Markets reacted negatively to this, as the US has always been seen as the most stable and creditworthy country in the world. At the same time as this, Congress has been debating President Trump’s “One Big Beautiful Bill Act”, which would raise spending and increase debt even further. The bill initially failed to get through the House of Representatives, with some Republicans voting against it. However, upon its eventual passing by just one vote, the market again reacted negatively due to concerns about the level of debt the US would incur over the next several years. The bill, which would bring in many of Trump’s campaign promises on tax breaks and spending increases, is still to be voted through by the Senate.

The Congressional Budget Office estimates that the bill will add $3.8 trillion to the federal government’s existing $36.2 trillion deficit over the next decade. US government debt is currently 124% of US GDP. Interest payments accounted for one out of every eight dollars spent by the government last year, which was more than was spent on the military. Concerns about US finances also led to the dollar’s 2% decline, its biggest weekly drop since ‘Liberation Day’, and yields on 30-year Treasuries reached their highest level since October 2023.

Despite all the uncertainty surrounding trade and US debt, the S&P 500 and Nasdaq indices recorded their best monthly returns since November 2023, rising 6.2% and 9.6%, respectively.

President Trump’s visit to the Middle East resulted in a host of trade deals being signed. Saudi Arabia agreed to purchase $142 billion of defence equipment from the US, Qatar agreed to buy 210 aircraft from Boeing, and an agreement was reached with the UAE, which would grant the country access to advanced chips and facilitate the construction of the largest AI campus outside the US.

India’s economy grew 7.4% in the first quarter, up from 6.2% in the previous quarter.

Argentina raised $1 billion from foreign investors through local currency debt, marking its return to global capital markets after seven years.

Bitcoin surpassed $110,000 for the first time after the US Senate introduced a regulatory framework for stablecoins.

Chinese electric car battery maker CATL held the largest IPO of the year with its secondary listing on the Hong Kong Stock Exchange, raising $4.6 billion. The company’s share price rose 16% on its first day of trading.

The Bank of England cut interest rates by a further 0.25%.

The UK and India agreed on a trade deal that is expected to add £4.8 billion to the UK’s GDP by 2040.