Markets experienced a decline in August, but a month-end rebound helped mitigate the impact. Traditionally, August and September are challenging months for market performance. Profit-taking is common in good years before Q4, while negative sentiment often prevails during challenging years. However, this is not overly concerning, given that much economic data suggests progress toward alleviating inflation pressures.

It’s possible that we’ve already witnessed the peak growth for the year, and we’re now anticipating a more stable year-end as we approach Q4. We believe any shift in monetary policy and interest rate cuts to boost markets further may not materialise until well into 2024.

In this update, we delve into the cooling data in the US, how adverse data from China might help curtail inflation in developed nations, and we also address the ongoing economic challenges in the UK.

However, we commence with an overview of the recent BRICS summit in Johannesburg, which dominated financial headlines during its proceedings.

The focal point of the month was the BRICS conference held in Johannesburg. BRICS represents Brazil, Russia, India, China, and South Africa – a group of rapidly growing economies that collectively account for 42% of the global population and approximately $28 trillion in nominal GDP, or 27% of the world’s total.

The term ‘BRIC’ was initially coined by Goldman Sachs economist Jim O’Neill in 2001. He believed these countries presented big investment opportunities as they could collectively dominate the world’s economy by 2050. In fact, this group of countries was never identified as a potential international organisation but simply as a term for investors. They formed a bloc and held their first summit in 2009 before adding South Africa in 2010 to become the BRICS group.

BRICS aims to provide an alternative to the G7, especially for developing nations, challenging Western, particularly US, influence in the global economy. The question on everyone’s mind is whether BRICS will reshape the world order and potentially challenge the US as the dominant global economic power. The answer remains uncertain.

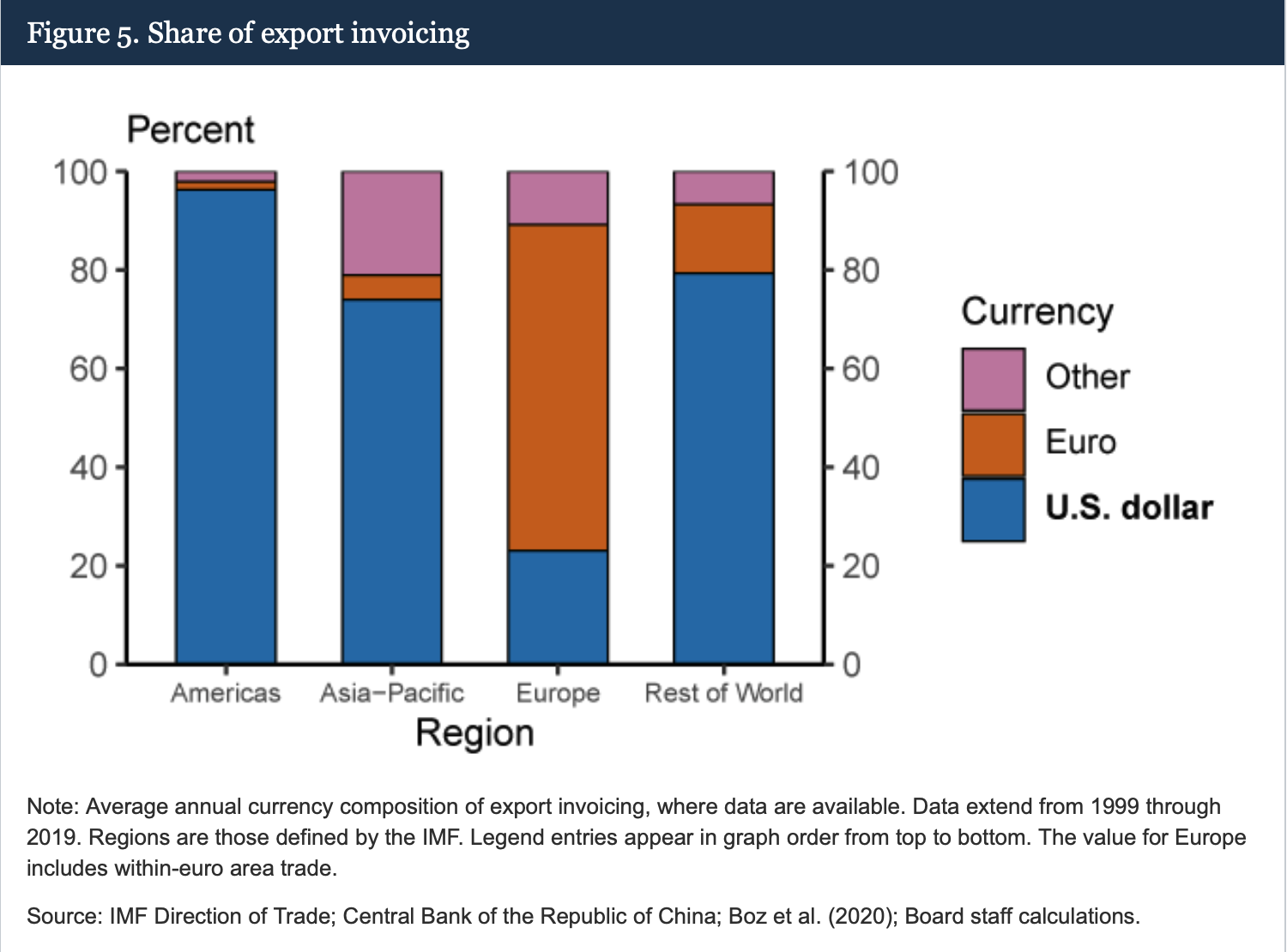

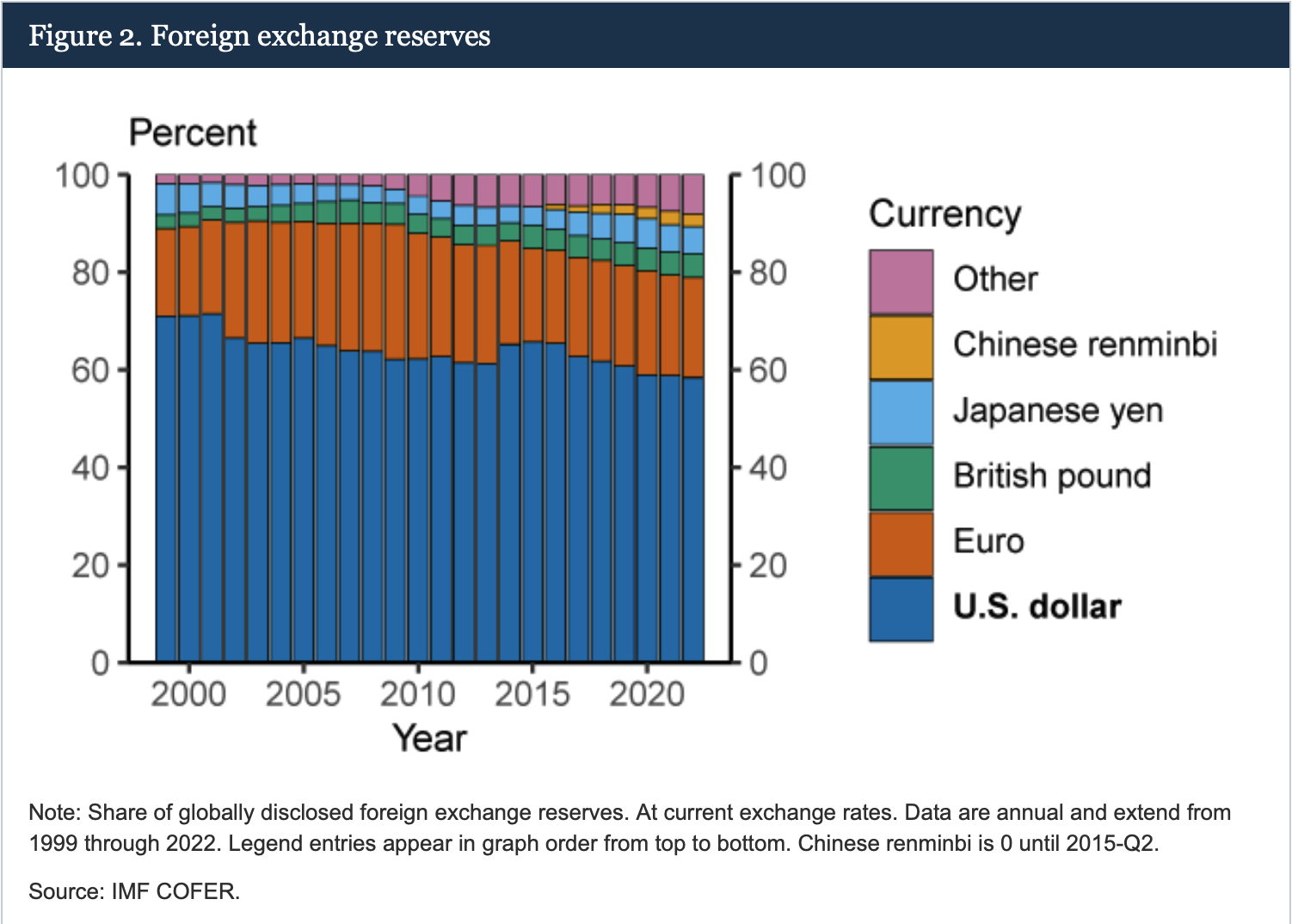

One of their key strategies is reducing reliance on the US Dollar, the world’s primary reserve currency and the preferred currency for global trade. To this end, BRICS has contemplated introducing its shared currency, potentially backed by gold, and established the New Development Bank (NDB) to support investments within BRICS nations.

However, challenges to a BRICS currency include the global confidence in the stability of the US Dollar, which remains a secure store of value and is used for 58% of the world’s global foreign currency reserves. Additionally, the lack of a unified economic market among BRICS nations, their diverse economies, and the constraints of a gold-backed currency pose difficulties. Even the NDB employs US dollars for transactions. The euro, British pound, and Japanese yen also see more widespread usage than the BRICS currencies.

Jim O’Neill, who invented the BRIC term, has also described the idea of a BRICS currency as unworkable. At the August summit, nations rejected the notion of introducing a BRICS currency (whether this will change remains to be seen).

Furthermore, diplomatic complexities exist within BRICS. China and Russia are allies when it suits them, but both have their own designs for pushing back against what they see as a dominant Western hegemony. Vladimir Putin did not travel for the summit in South Africa as it would have put the host nation in an uncomfortable position – as members of the International Criminal Court, South Africa would have had to, under international law, arrest Putin due to the ICC’s investigation into him for potential war crimes in Ukraine. Xi Jinping will not travel to India for the upcoming G20 summit, which many see as being due to rising tensions between the two nations over border disputes in the Himalayas. These countries do not always get along so well.

With that being said, there will likely be some de-dollarisation as other countries look to BRICS to help reduce their reliance on the greenback. The August summit saw the bloc agree to add Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the UAE to its ranks, and it is also looking to expand further.

Ultimately, the US Dollar’s status as the global currency may change in the future, as history has shown with currencies like the British pound, French franc, and Dutch guilder. In fact, the average time a currency holds its position as the global lead is 94 years, and the US dollar has maintained its global status for 99 years. Analysts suggest that a multi-currency reserve system is more probable than a single dominant global currency.

BRICS nations settling trades in local currencies, such as the recent UAE-India oil trade transacted in rupees, could set a precedent for others, but the US dollar’s dominance as the primary global currency is unlikely to diminish anytime soon.

In July, US CPI increased to 3.2% from 3% in June, contrary to the year’s trend of slowing inflation. However, this rise was not entirely unexpected, considering that July last year saw lower inflation than June.

In addition, GDP growth for the second quarter was revised downward to 2.1% from 2.4%, signalling a cooling demand. In August, the US added 187,000 jobs, but the unemployment rate unexpectedly rose to 3.8%, indicating more people are rejoining the workforce. Average hourly wages increased by 4.3% annually, albeit lower than in July.

While the labour market remains resilient, there are hints that it might be cooling. During his speech at the Jackson Hole symposium for central bankers, Jerome Powell, Chair of the Fed, cautioned against complacency in the fight against inflation. He warned of the potential need for further interest rate hikes to prevent entrenched above-target inflation, even if it comes at a high employment cost.

Despite these warnings, recent US data strengthens the belief that the Federal Reserve can achieve a “soft landing” for the US economy.

In July, China faced simultaneous drops in consumer and producer prices for the first time since 2020. The country was pushed into deflation, with CPI down by 0.3% year-on-year. Factory activity recorded its fourth consecutive monthly decline.

The Chinese government opted not to disclose the latest unemployment figures for young people, with the previous data from June showing a record high of 21.3%. However, nationwide unemployment figures rose to 5.3%.

Despite expectations of a significant post-lockdown rebound, China’s economy has not witnessed the anticipated recovery, with consumer demand declining. This has put pressure on Beijing to implement more direct policy stimulus measures, and the key base rate was cut in an attempt to drive growth.

The property market is also in decline, with sales among the largest 100 Chinese developers dropping by 33% year-on-year in July. Troubled property giant Evergrande sought bankruptcy protection in the US, citing restructuring proceedings in Hong Kong, the Cayman Islands, and the British Virgin Islands. Despite owning 1,300 projects in 280 Chinese cities, the company has incurred a combined loss of $81 billion over the past two years.

Another major property developer, Country Garden, reported a loss of $7.5 billion for the first half of the year and failed to meet coupon payments totalling $22.5 million on some of its bonds, leading to the suspension of trading in these instruments.

Exports experienced a rapid decline, dropping by 14.5% year-on-year in July. This trend may assist Central Banks in other countries grappling with inflation issues, as Chinese manufacturers are compelled to reduce prices to clear stock. Lower prices could potentially filter through to end-user markets in developed nations, contributing to the reduction of inflation.

Furthermore, the United States has intensified efforts to limit China’s capacity to advance its military and surveillance technology. President Biden has imposed restrictions on the amount of US investment that can flow into China, mainly targeting Chinese semiconductors, AI, and quantum computing. These measures could potentially impede China’s technology sector, although China has yet to retaliate, as investors anticipate they will do.

The Bank of England carried out its expected 14th consecutive interest rate hike, pushing the base rate to a 15-year high of 5.25%. The UK continues to grapple with elevated inflation. Although CPI notably decreased from 7.9% in June to 6.8% in July, primarily due to declining energy prices, it remains higher than in most other major economies. Core CPI, excluding food and energy, remained steady at 6.9% year-on-year from June to July.

Bank of England Governor Andrew Bailey cautioned that a rate reduction would require assurance of inflation receding towards the 2% target. The Bank is likely to maintain higher interest rates for an extended period, aligning with the strategy of other central banks to bring inflation under control. Some analysts anticipate interest rates remaining above 5% for the next 12 to 18 months.

On a positive note for the UK, the latest GDP figures revealed economic growth of 0.2% for the second quarter and 0.5% for June, both surpassing economists’ expectations. Consumer confidence rebounded in August. However, the flip side of economic resilience is the potential to exacerbate inflation, potentially necessitating further rate hikes by the Bank of England. Furthermore, despite economic growth, the UK remains the only G7 nation yet to return its GDP to pre-pandemic levels. Private sector output experienced a sharp decline in August.

House prices fell by 5.3% year-on-year in August, the biggest annual fall since 2009. Higher mortgage rates have contributed to the fall, which is unlikely to abate soon without a cut on the base rate.

The economic landscape in the UK has led economists to speculate that a slowdown or even a recession could loom in the near future.

Saudi Arabia and Russia committed to further output cuts in September. According to the latest figures from the International Energy Agency, global oil demand had also reached a record high of 103 million barrels per day in June.

Reduced supply and increased demand have pushed oil prices higher, with Brent Crude back up to $88.55 per barrel, having been at a 2023-low of $71.44 in March.