May saw a rebound in stock markets as economic data, particularly out of the US, suggested a slowdown, and markets had digested their revised expectations of fewer rate cuts to happen in 2024 than had originally been anticipated.

The MSCI World Index was up 3.5% at the end of May, reversing April’s decline and briefly surpassing it before a slight pull-back in the final week of the month.

May’s market update includes a brief commentary on the impact of elections on stock performance before looking at inflationary data from the US and the Eurozone. We also cover important data and market news from China, the UK, and Japan before rounding up some other relevant and interesting news items from the month.

Many clients have asked us recently about the election’s impact on stock market performance. This is best summarised by atomos, provided on their weekly market update from 24th May:

“Whilst equity returns are indirectly impacted by political actions, these actions are not the main determinant of how any company’s shares perform. Certainly, given an investment horizon of at least five years and, in many cases, much longer, short-term political decisions, especially when considered in the context of four-year terms for the US and up to five in the UK, should be understood as just one factor among many in a wider analysis of markets. In fact, research by Bloomberg has shown that average annual return is only marginally affected in political election years, and volatility has actually reduced in the period approaching and immediately after elections. This lends credence to the idea that the current political ‘noise’ in the US and UK election years is just that – noise.”

We, therefore, advise that it is better to always bear in mind the importance of being a long-term investor and not making knee-jerk reactions or short-term decision-making based solely on political factors of an election year. This is particularly notable in a year such as this one, where many elections are happening worldwide. The elections may have some impact, especially in the short term, but they are just one of many factors to be considered.

Markets continue to watch for slowing economic data as a sign that monetary policy is working, and there was a positive reaction to only 175,000 jobs being added in April. This was below expectations, and almost half the number of jobs added in March. Whilst it may seem counter-intuitive for markets to be positive on poor economic news, it is a sign of the times, where slowing economic data means higher interest rates are doing their job and that the likelihood of an interest rate cut increases, which is positive for the market.

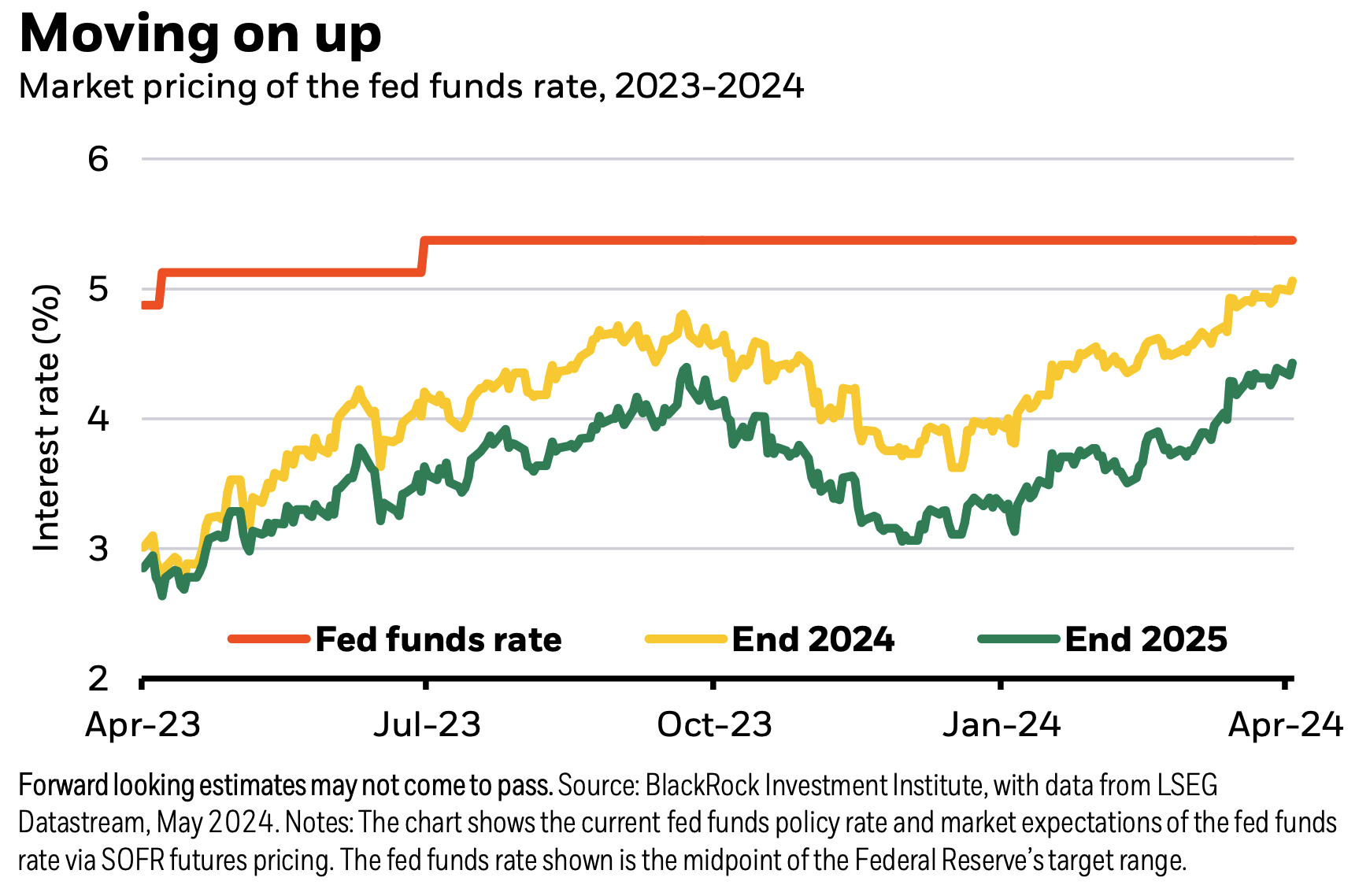

The Fed kept interest rates unchanged at 5.25-5%, citing a “lack of progress” on lowering inflation, which was falling more slowly than anticipated. Annual inflation fell to 3.4% in April from 3.5% in March; core inflation was at its lowest level since April 2021, at 3.6%. Core PCE, the Fed’s preferred measure of inflation, increased 0.2% from the month before, as expected.

Inflation is becoming less of a concern for companies listed on the S&P 500, with the number of them mentioning inflation during quarterly earnings calls having peaked in Q2 2022 and the number of references falling for seven consecutive quarters since then.

The slowing job data increased speculation that a rate cut could happen in September (after last month’s revisions that it would be pushed back to November). The general consensus remains that there will be cuts of 0.25% to 0.5% before the end of the year, which is in sharp contrast to forecasts made at the end of last year for several 0.25% cuts in 2024.

Factory activity increased for the second consecutive month in April, raising hopes that this recovery could be sustained. Western demand for Chinese exports helped to fuel that turnaround; however, manufacturing unexpectedly fell in May.

The Biden administration announced increased tariffs on several goods, which will affect an estimated $18 billion worth of imports. Chinese-made electric cars were hardest hit, with tariffs rising from 25% to 100%. Solar cells and certain steel and aluminium products will also see large hikes in tariff rates, with China vowing “resolute measures” in response.

Authorities announced further support for the property sector, with the central bank creating a $41.5 billion lending facility for state-owned companies to buy properties and re-sell them as affordable housing. For individuals, first-time buyers will see a cut in the minimum down payment from 20% to 15%, and second-time buyers will see the level drop from 30% to 25%. The property sector has been under increasing pressure since the debt-laded problems of Evergrande became apparent, with new home prices falling for ten months in a row, and the recent 0.6% monthly decline was the biggest drop since November 2014.

Plans were also announced to stimulate areas such as food security, energy, and manufacturing via a long-dated bond issue of $140 billion with maturities of up to 50 years.

The IMF has upgraded its forecast for economic growth in China, estimating 5% growth in 2024 and 4.6% in 2025, which is a half-percent increase on both forecasts. It did, however, also say that consumer-friendly reforms were needed to sustain high-quality growth and that subsidies supporting manufacturing at the service industry’s expense should be scaled back.

The Bank of England also left interest rates unchanged at 5.25%. A key takeaway from the announcement was comments made by the Bank’s Governor, Andrew Bailey, suggesting that rates may need to be cut over the coming quarters and that they may make monetary policy less restrictive over the forecast period. However, he also used language that made clear that future data would have to support these ideas.

The UK economy bounced back from the technical recession at the end of last year, which was the mildest recession for 70 years, with Q1 GDP growth above expectations at 0.6%. This was also the best figure since 2021. Inflation also fell from 3.2% in March to 2.3% in April, and whilst this is a significant decrease, it was still less of a drop than had been expected. The consensus is that inflation will fall to 2.1% – just ten basis points above the BoE’s 2% target – however, the BoE has also released a forecast showing that CPI could rise again to 2.6% by the end of the year.

Prime Minister Rishi Sunak announced a general election for 4th July. The IMF has been sceptical about spending plans being touted by all parties, suggesting that tax increases or spending cuts will be needed to fund specific plans, particularly on the NHS and green investments. However, after 14 years of spending cuts and a cost of living crisis, announcing as an election candidate that you would support further cuts or an increase in taxes is not likely to go over well with the electorate. It creates a dilemma for whoever will be in the next government, and after 4th July, a clearer picture will emerge regarding the potential direction of the UK economy.

The yen rebounded sharply in the first week of the month, fuelling speculation of central bank intervention having taken place for the first time since 2022. This came after the currency was at a 34-year low against the US dollar. The weak yen has helped Japan cement its place as the world’s largest creditor, with net external assets up 12% year-on-year to JPY 471.3 trillion ($3 trillion).

The slowdown in consumption in Japan due to a rising cost of living saw the economy contract at an annualised rate of 2%.

The BoJ left interest rates on hold at 0-0.1%.

Inflation in the Eurozone remained steady at 2.4% in April, and core inflation slowed to 2.7% from 2.9% in March. The Eurozone economy also grew by only 0.3% in the first quarter of this year.

Inflation increased again in May to 2.6%, a higher annual rate than had been expected. However, the consensus remains that the ECB is likely to cut interest rates during its June meeting.

Apple announced the largest share buyback in history, saying they would repurchase $110 billion worth of its shares, which is 22% more than last year’s buyback. This was after revenue fell by 4% in Q1.

On 17th May, the US’s Dow Jones Industrial Average index saw its fifth consecutive weekly rise to close above 40,000 for the first time.

Saudi Arabia announced plans to sell a second tranche of shares in Saudi Aramco. They will sell 0.64% of its shares, worth $12 billion, to help the country fund its economic diversification plans.

Futures on orange juice reached an all-time high after groves in Brazil were hit by bad weather and disease. Brazil is the world’s largest producer of orange juice, and the weather has led to expectations of a bad harvest, which follows two years of reduced yields in America.

Meme stocks came into focus again, with a slew of investment back into GameStop following encouragement from Keith Gill, known as Roaring Kitty on social media, who caused the original meme stock craze in 2020/2021. All he did this time was post an image of a video gamer leaning forward towards his screen, and billions of dollars of value was added to GameStop shares.