August began with a sharp market drop following market concerns over a possible US recession and investor fears that the large and mega-cap tech companies, which have been driving markets this year, might not be able to achieve the expected returns from all of the hype around AI. Almost as quickly as it began, the market drop sharply reversed. The remainder of the month saw a strong rebound as investors reassessed economic conditions and appeared to believe that the initial drop was an overreaction.

A slower than expected Jobs market in July, with the US adding just 114,000 jobs and a rising unemployment rate for the fourth consecutive month, contributed to fears over the economic slowdown and possible recession, with stocks falling sharply in the first week of August. The S&P 500 saw swings of 1% in each of the last three trading days of the week, and the Nasdaq entered correction territory, having fallen more than 10% from its peak; the MSCI World Index fell by 6.4% in the first five calendar days of the month.

While the MSCI World recovered 3% the following week, US markets remained volatile. They finished that week flat, after sharply falling on the Monday and Tuesday before recovering in the final three days of the week. The VIX index, a measure of market volatility, reached its highest level since the Covid-19 pandemic.

Not only was the economy a concern, but investors are worried that with all of the hype around AI, companies which have expended huge amounts of capital into AI investment may not see returns quickly. Whereas past tech investment has led to surging revenues, there are questions over whether the additional revenue from AI alone will justify all of the capital being spent on it.

Japanese stocks had their worst-ever three-day run, and the Topix suffered its worst daily performance since 1987, dropping by 12% in a single day, as the yen strengthened following a rise in interest rates from the BoJ and hurt investors who had borrowed cheaply in yen to take high-yielding positions in dollars. As a sign of the week’s volatility, the index rebounded by 11% the following day, and the BoJ’s governor said that no further interest rate rises were expected in the short term.

Following this, US markets had one of their strongest weeks of the year and recovered from the losses they had suffered at the beginning of the month.

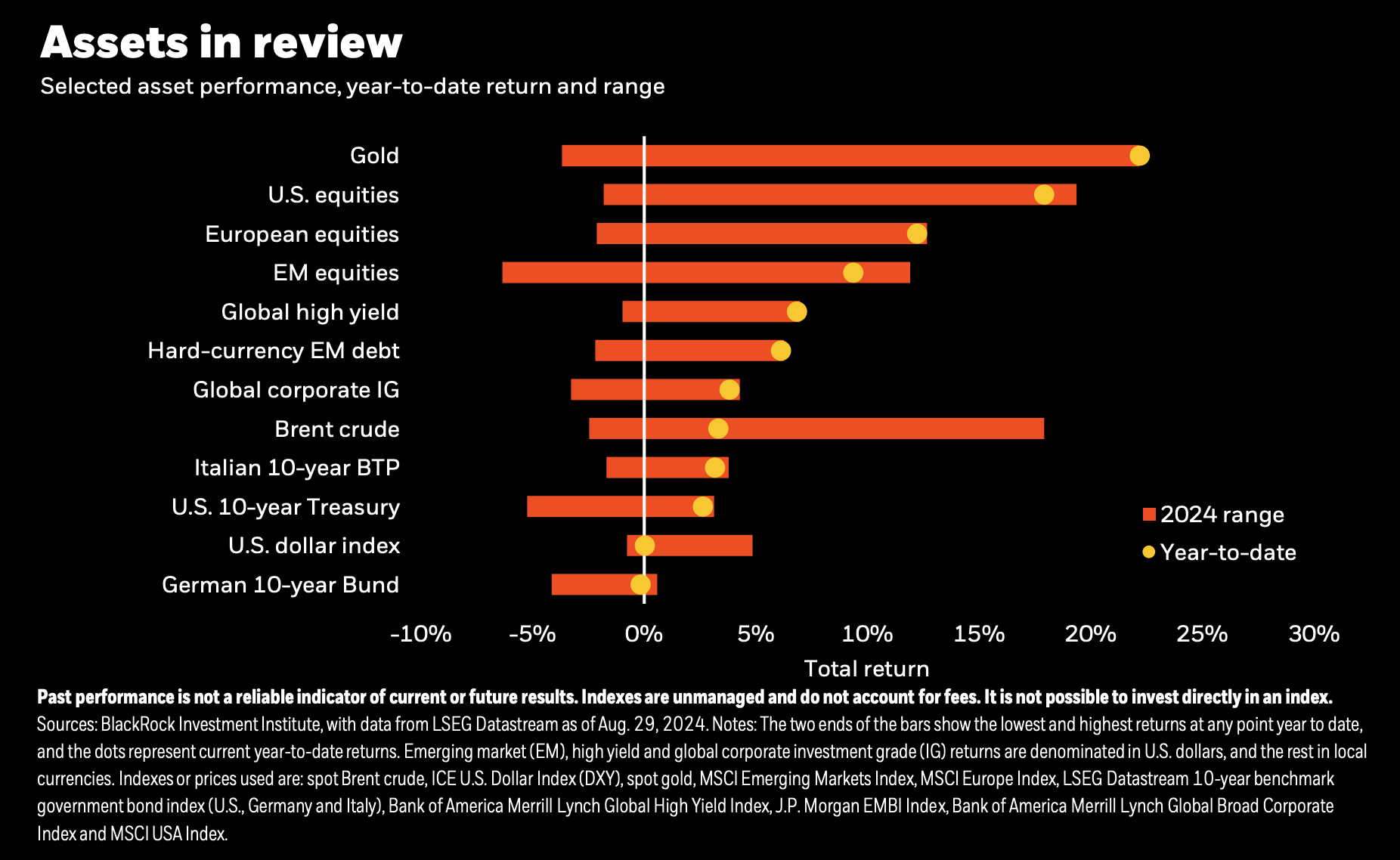

Gold continued its rise and has gained more than 20% since the start of the year. Investors started buying strongly into gold in August for two reasons: firstly, it is seen as a safe haven asset when markets are falling, and secondly, the price of gold traditionally rises when interest rates fall, and markets expect the Fed to begin cutting rates in September.

The Fed left its main interest rate unchanged but said there was “progress” on getting inflation to the 2% target and that they were “moving closer” to a rate cut. Markets expect a mid-September cut from the Fed, and chair Jay Powell signalled that a cut was coming, saying it was time for “policy to adjust”. US inflation fell to 2.9% in July, the first time it has been under 3% since March 2021.

The Bank of England cut rates for the first time since March 2020, bringing the headline rate down by 25bps to 5%. Inflation did rise to 2.2% in July, marking the first month this year without disinflation in the UK. However, this was below expectations of 2.3%, and markets are pricing a higher probability of a second 0.25% rate cut in September.

The Bank of Japan, meanwhile, raised rates for only the second time since 2007, bringing its main interest rate up from 0-0.1% to 0.25%. The Bank also forecasts inflation to stay around 2% for the next few years and has laid out plans to halve its bond-buying programme over the next two years. Kazuo Ueda, the Bank’s governor since April, has been taking a much different and more assertive approach than his predecessor, presenting a new stance on Japan’s monetary policy.

The eurozone economy grew by 1% annually in the second quarter. However, Germany’s economy contracted again.

China’s manufacturing activity fell for the third consecutive month in July.

China filed a complaint with the WTO over the EU’s tariffs on its electric vehicles, which are between 26% and 48%. The EU has accused China of unfairly subsidising its electric vehicle industry, whilst China believe the tariffs “severely violated” WTO rules and went against cooperation on climate change.

Japan’s economy grew by 3.1% annually in the second quarter following a Q1 contraction, well above expectations of 2% growth after private consumption rose.

India saw its biggest IPO in two years as Ola Electric Mobility, which makes electric road scooters, raised $732 million on the Bombay Stock Exchange.

Saudi Aramco announced its annual dividends to investors will be $124 billion, but the chief executive believes that markets are ignoring the demand for oil. Oil prices, having risen 20% by April, have now all but erased those early gains.