This month’s update focuses primarily on Donald Trump’s victory in the US presidential election and what this might mean for markets.

Donald Trump completed a remarkable political comeback by winning the US presidential election by an electoral college landslide, with all seven of the key swing states going his way. Trump also won the popular vote for the first time in his three presidential campaigns, giving him a strong mandate to enact his policies. The Republicans also won the trifecta of the White House, the Senate, and the House of Representatives, making it easier to vote through Trump’s agenda (until the midterm elections, at least).

The US economy was a decisive factor in many voters’ decisions. Although the US economy is very robust and appears to be heading for the soft landing that the Fed has tried to achieve, many Americans feel as though the economy is not doing well. The data on how the economy is doing well doesn’t matter to them: they have seen prices rise and blame the Biden administration for high inflation. Although inflation is now close to target, prices have not fallen, and it will take another year or two for people to adjust to these new prices being the norm. Trump will inherit a strong economy and falling inflation, which will likely get his presidency off to a strong start from an economic standpoint.

Many of our clients ask, “What does a Trump presidency mean for markets?” Trump is very much a pro-business president, preferring lower taxes and more deregulation. He reduced corporation tax last time he was in office and has talked about doing the same again. He wants to deregulate so businesses have fewer hoops to jump through to get things done. This is seen as positive by the markets, which, following his victory, had their strongest weekly gains in a year to reach new record highs.

However, markets then pulled back over one of Trump’s key policy issues: tariffs. Trump believes that US businesses are suffering from the import of cheap goods, or goods made with cheaper labour, and wants to protect American businesses by bringing more manufacturing back home. Therefore, he wants to target other nations with high tariffs to make their products more expensive to import. In particular, Trump wants to go after China, as he did in his last term. He has also spoken about the EU and, since his victory, has demanded action from Mexico and Canada on immigration or face tariffs. Trump views tariffs as an economic weapon that will damage other countries. In reality, most economists believe that tariffs will only hurt US consumers, as businesses making these imports are the ones who pay the tariffs, and those additional costs are ultimately passed onto their customers. Countries targeted by tariffs do not pay them (despite what Trump and his supporters say) and often impose retaliatory tariffs of their own onto the US.

Higher prices for US consumers would lead to an increase in inflation again, which could be negative for markets. Inflation remains a hot topic for the market over who is in the White House. Policy will be more important than personality.

After the pullback, the US market kicked back into growth mode and finished the month of November in positive territory, with the S&P 500 closing the month at 6,032 for a monthly gain of 3.76%.

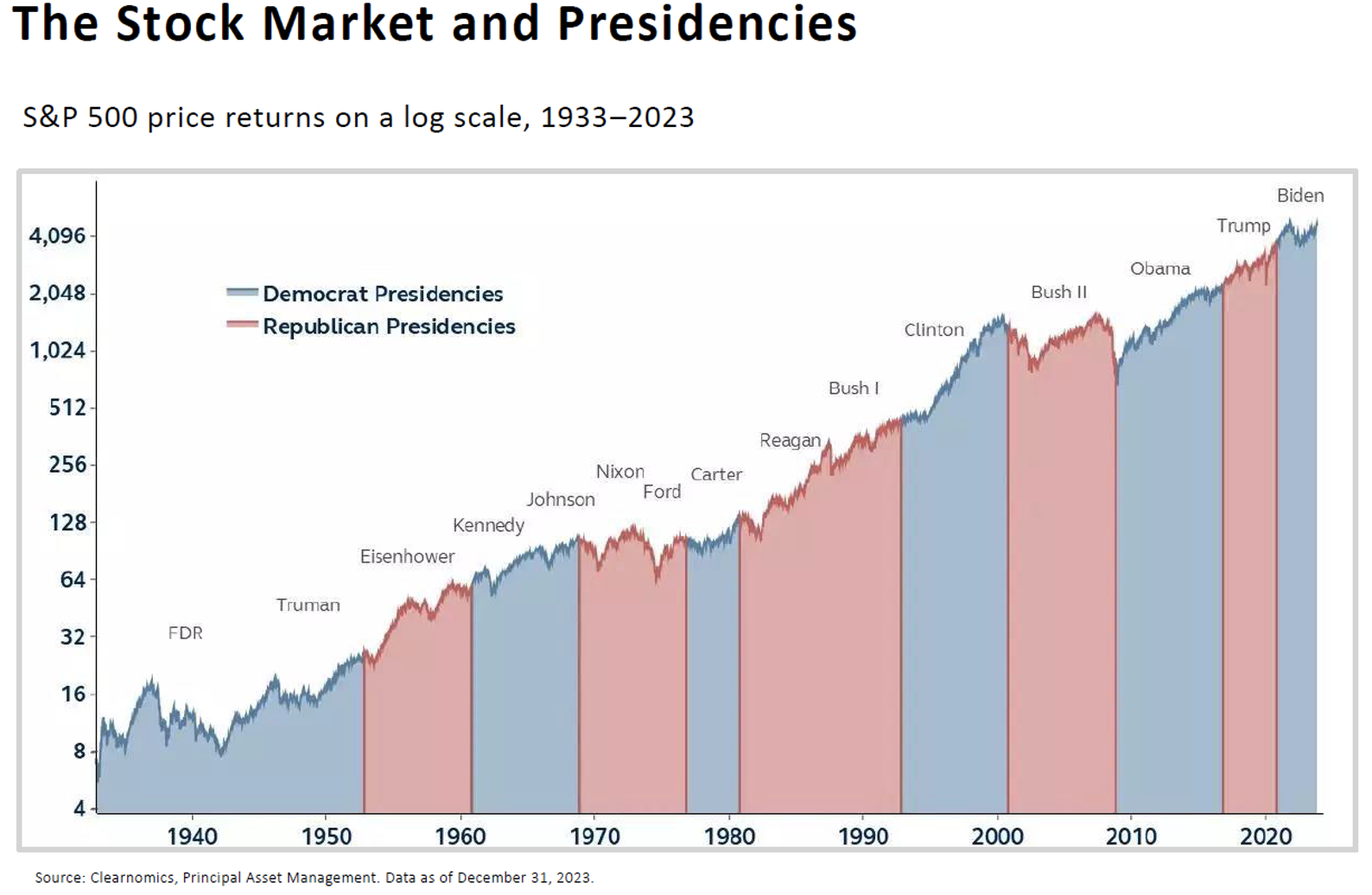

Trump has been in office before, and the stock market has risen. We had one significant downturn during the fourth quarter of 2018 when he began his trade war with China, so tariffs are certainly something to watch over the next four years. The other downturn was during the COVID pandemic, and whatever you think about how he handled that event (let’s not forget that this is the man who said it would just disappear and advised people to drink bleach), this downturn was not a result of policy.

We believe that we can expect volatility from a Trump presidency, as his rhetoric is itself volatile, and the market listens to the most powerful man on the planet. His tweets often moved the market downwards, so his social media announcements this time are likely to cause a similar reaction.

Markets rose during Trump’s last term in office, and we should also remember that regardless of who the president of the US was, the market still performed strongly.

US annual inflation rose for the first time since March, going up to 2.6% in October from 2.4% in September, although core inflation (which excludes food and energy prices) remained at the same level of 3.3%. Fed Chair Jay Powell said the economy is still growing, and the job market remains steady. However, inflation hasn’t yet fallen to the 2% target, meaning the central bank will deliberate carefully over rate cuts. Following these remarks, the probability of another 0.25% rate cut in December fell, although most believe a cut will still likely happen. Powell’s indications do suggest that the Fed is in no hurry to cut, so there is the potential for the return of something similar to the “higher-for-longer “narrative we saw earlier in the year.

UK inflation rose sharply from 1.7% annualised in September to 2.3% annualised in October. The energy bill price cap increased, leading to prices going up, but even taking energy out of the equation the UK saw its core inflation also rise to 3.3% annualised.

Argentina’s annual inflation was 193% in October, the first time falling below 200% in nearly 12 months.

Nvidia’s annual revenue hit $35.1 billion in Q3, almost double the figure from the same period last year. The company said it expects higher revenue in Q4. Once again, with Nvidia, the share price dropped on the announcement, and although the figures were exceptionally strong, they weren’t as strong as investors had hoped.

The Biden administration finalised a deal with TSMC for $6.6 billion in grants to build chip-making factories in the US. The company will also receive a further $5 billion in loans.

There was a sliver of positivity in the Chinese property sector, with 76.5 million square metres of new floorspace sold in October. This was 1.6% lower than a year ago, but the decline was much smaller than the 11% difference from September, suggesting buyers may be responding to recent stimulus efforts from the Chinese government.