This month’s focus is again on tariffs and trade wars, with a slew of announcements from the Trump administration, including heavy tariffs on virtually every country in the world, a 90-day pause (except for China), and roiling financial markets.

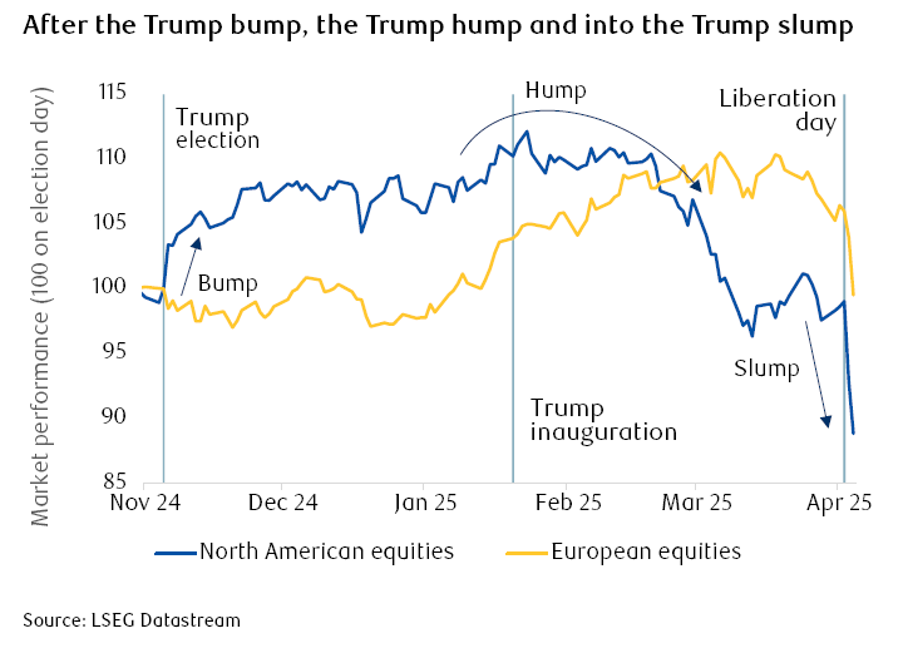

By the end of the month, most of the market declines from the Liberation Day announcement had reversed, but the market remains down from its highs in mid-February.

We cover what has happened and some of the data around the announcements. We also remind investors that the long-term is important, and volatile periods such as this can create opportunities.

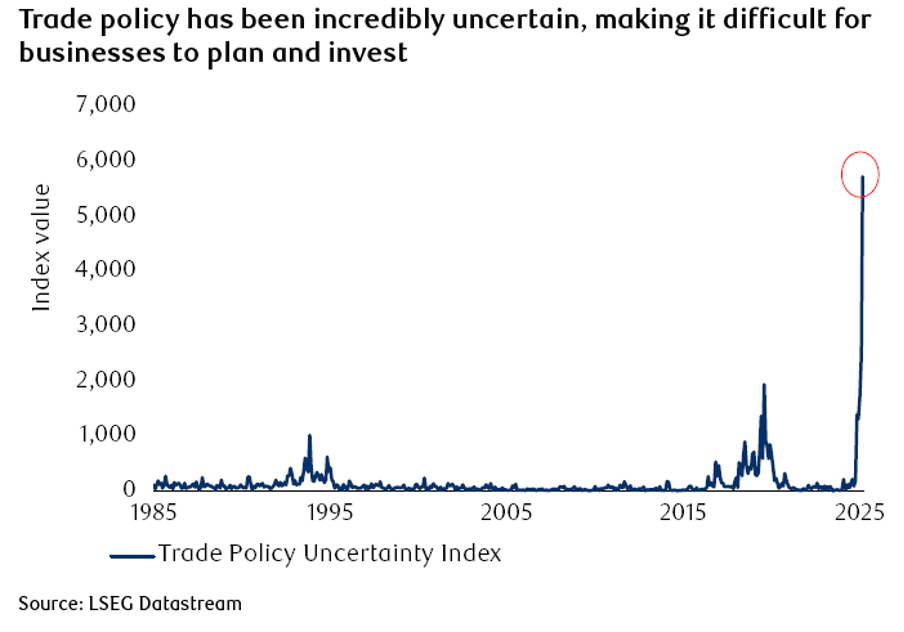

2nd April marked the day on which President Trump announced “Liberation Day”, displaying the infamous board of what his administration is calling “reciprocal” tariffs against other nations, with an equation that somehow appears to try and take into account average weighted tariffs from those nations on the US goods which they import. It was a sweeping change in global trade, with almost every country hit with a 10% baseline tariff plus additional tariffs dependent upon what their equation had apparently calculated. Very few places escaped lightly from the latest assault on the order of global trade, with some notable highlights: an island inhabited by penguins was hit with tariffs; Russia was exempted as Trump did not want to put this pressure on them during negotiations to end the war in Ukraine, whilst Ukraine itself was hit with tariffs, as were European allies who also want to see an end to the war; countries like the UK and Singapore were subject to the 10% baseline, even though the US has a trade surplus with these countries, which goes against Trump’s reasoning that he wants to cut the US trade deficit.

The end game for these tariffs remains unclear, with mixed messaging from the administration. One of the reasons given is to bring manufacturing jobs back to the US. This seems to be an overly ambitious target, as the US does not have the workforce or skillset to compete with manufacturing in Asia, and particularly China. China has spent decades positioning itself as the world’s factory, and its labour costs are lower than in the US. Will companies like Apple and Nike move their manufacturing base to the US? This seems unlikely. They have expanded into other territories, such as India and Vietnam, to diversify the supply chain from Trump’s main target of China. Still, these countries are also now subject to tariffs. The result of this would appear to be simply that costs for American consumers will just go up, which many business leaders and economists have warned of.

The US, the dominant force in global trade, with the largest economy and the strongest currency (but has been treated unfairly, according to Trump), is now operating under a protectionist regime, causing uncertainty worldwide and in financial markets. Trump’s election was expected to drive the stock market higher due to his pro-business and low tax sensibilities, but it dropped sharply as trade tensions ratcheted up, and even further following the Liberation Day announcement.

In this downturn, European equities outperformed US equities, as the market sees the US as being more affected by its own tariffs. The US’s weighted average import tariff was heading towards 28%, which caused investors to be concerned about the growth of the US economy.

But it wasn’t just stocks that fell. Typically, the bond market would perform well during a stock market decline, but bonds also sold off rapidly following these announcements. Bond markets can be a good barometer for the merits of economic policy – think back to the Truss mini-budget in the UK from 2021, which was reversed following a collapse in the bond market and led to the end of her tenure as Prime Minister. US government bonds became less secure than they previously had been – the US was no longer a reliable and stable country in the eyes of the bond market.

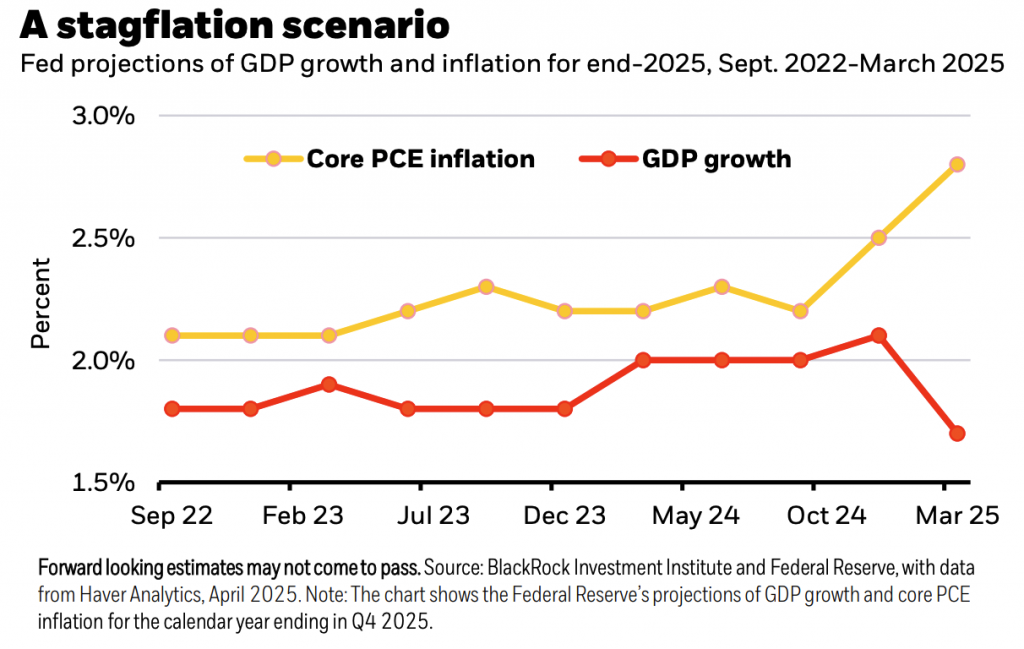

Trump’s Treasury Secretary Scott Bessent understands markets from his career in financial services and is on record for saying that tariffs are inflationary (he changed his public opinion during his nomination to his current role). It is believed that he is the one to have spoken to Trump about easing his position following the decline in bond markets, although we may never know for sure.

Trump announced a 90-day pause on his tariffs (except for China), citing the need to allow time for negotiation. However, reversing course due to a market decline may have highlighted a pressure point for other countries to use during those negotiations.

The market reacted positively following this, and there was a strong rebound for the remainder of the month, but uncertainty remains, particularly as the baseline 10% tariff stayed in place.

Tariffs have already had an impact on the US economy, with GDP contracting by 0.3% during the first quarter, as companies stockpiled goods ahead of incoming tariffs. Many economists believe this is simply a goods stockpiling data point and does not reflect the US economy as a whole, with job growth continuing to be seen. Any long-term impact of tariffs remains to be seen. Of course, it depends on the administration’s final tariff position after any negotiations.

An impact is also expected on global growth, with the IMF revising its forecasts down from 3.3% growth to 2.8% for the global economy this year. US growth is also forecast to be lower than previously, whilst the Fed expects to see a simultaneous rise in inflation due to rising prices from the tariffs, which could further slow them down in cutting interest rates.

US markets have reversed the majority of the losses following Liberation Day, seeing nine consecutive days of growth for the first time since 2004, but we expect some volatility to remain whilst uncertainty is high. Moments like these can create investment opportunities and should be viewed with the long term in mind.

Markets were also rocked by Trump calling Jay Powell, Chair of the Fed and a Trump appointee from his first term, a “major loser” and announcing he wants him out of the job. It’s not clear that the President has the power to fire the Fed chair, and Trump reversed his rhetoric the following day, saying he had no intentions to fire Powell, which reversed the 2.5% market loss seen from his initial speech.

Warren Buffet announced he would retire as chief executive of his investment firm, Berkshire Hathaway. Buffet, probably the world’s most famous investor, has run the company since 1965, and is the company’s largest shareholder with stock worth $160 billion.

GDP in the eurozone grew in the first quarter by 0.4% from Q4 2024 and 1.2% year-on-year. The ECB recently cut interest rates again, fearing a trade war that could hurt the euro area economy, taking the base rate down to 2.25%.

China’s GDP grew 5.4% year-on-year in Q1, and the country believes it will hit its 5% target for this year despite the trade war with the US.

Tesla’s revenues dropped 9% and net profits fell 71% in Q1. Tesla faces increased competition from Chinese electric cars and pressure on its sales from Elon Musk’s association with the Trump administration.

Deliveries fell 13% and more heavily in Europe, and investors want to see Musk focus more on the company than on his role in Doge.

Pistachio kernel prices have risen by 35% in the last year due to a worldwide shortage of the nut, driven by the global popularity for ‘Dubai chocolate’.