Stock markets maintained robust performance throughout February, with the MSCI World Index gaining an additional 4% for the month. This brought its year-to-date performance to a positive 5.3% return.

In contrast, the bond market faced ongoing challenges as Central Banks resisted market expectations of swift interest rate cuts.The momentum from the late 2023 rally did not extend into 2024, as participants in fixed-income markets reevaluated and adjusted their expectations for the timing of rate cuts.

Stocks tied to AI themes have remained strong performers this year, with Nvidia notably continuing its remarkable surge. The company has seen growth of +507% since the beginning of 2023 and an astonishing +2,255% over the last five years. We will review select stocks in this space and discuss strategies for managing portfolio exposure to the AI theme.

In January, the US Consumer Price Index (CPI) decreased to an annualised rate of 3.1% from December’s 3.4%, although the decline was less than anticipated. This occurred amid signs of resilience in both the economy and the labour market.

A significant contributor to the headline inflation figure was the increasing cost of shelter. Shelter inflation, which typically lags other inflationary factors by about 18 months, reached 6% in January. The Core CPI, which excludes food and energy prices, was recorded at an annualised rate of 3.9%. Shelter expenses make up roughly 45% of the Core CPI, and excluding them, the Core CPI stood at 2.2% in January.

The Federal Reserve has pushed back against market expectations of six rate cuts in 2024, advocating for patience and a data-driven approach. Markets are now anticipating three rate cuts, with one expected in the first half of the year. This stance has not favoured bond markets, which are waiting for rate cuts to boost prices. Bond yields reached new highs for 2024 amid re-evaluations of potential Fed policy decisions, including concerns expressed in the minutes from their January meeting about the risks of premature rate cuts.

The Core Personal Consumer Expenditures Index, the Fed’s primary focus, registered a year-on-year increase of 2.8%, marking the smallest annual rise in three years. This has bolstered optimism for the possibility of the first rate cut occurring in the first half of the year.

From a market perspective, the S&P 500 achieved new record highs, surpassing 5,000 and then 5,100 for the first time. Companies have been reporting robust earnings, and the services sector experienced its strongest growth in four months.

The UK slipped into a technical recession as GDP contracted by 0.3% in Q4, marking the second consecutive quarter of negative growth. Adding to the grim news, the contraction was more severe than economists anticipated.

Projections indicate that wages in the UK will outpace inflation this year. However, it is anticipated that poorer households will not regain their pre-pandemic spending power until 2027. The National Institute of Economic and Social Research (NIESR) has called on the upcoming government to prioritise economic growth through investment rather than focusing on tax cuts for voters.

Unemployment dropped to 3.8% in Q4 from 4.1% in Q3. Data on unemployment and wages reveals a tight labour market, raising concerns that without a cooling-off period, the Bank of England could struggle to bring inflation down to its 2% target. Inflation remained stable at 4% in January, which was viewed positively in contrast to market expectations of a rise to 4.2%.

This data poses challenges for the Bank of England, which requires higher interest rates to combat inflation but might also need to lower rates to stimulate growth following the recession.

Japan entered a technical recession as its GDP contracted for the second consecutive quarter, shrinking by 0.1%. This development led to Japan losing its position as the world’s third-largest economy to Germany. The most recent data has raised doubts about the likelihood of policy changes from the Bank of Japan.

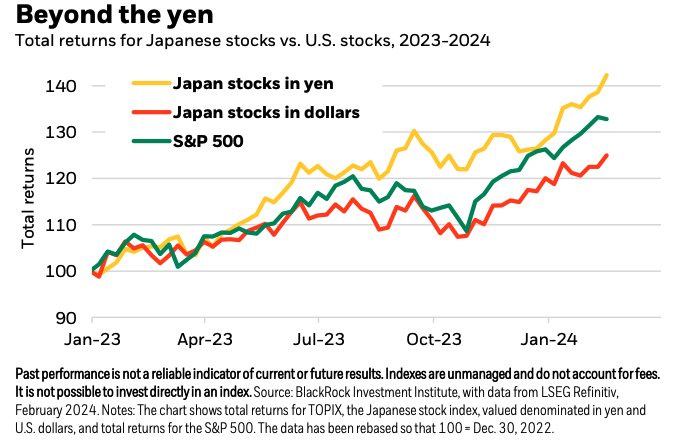

Despite these challenges, the Japanese stock market continues to surge. The Nikkei 225 surpassed 34,000 for the first time in 34 years and then went above 39,000 to reach a new record high, with year-to-date growth exceeding 18%. The weakened yen has contributed to improved profits for companies that generate a significant portion of their revenue abroad. Corporate governance reforms, driven by the Tokyo Stock Exchange, have incentivised firms to enhance their profitability and increase shareholder returns.

Even with the market at an all-time high, investor sentiment towards Japan remains bullish. The TSE (Tokyo Stock Exchange) will disclose those companies with plans for improving capital management, which should prompt those trading below book value and without growth strategies to implement expansion plans. Reforms have notably enhanced returns on equity, with profitability for TOPIX companies rising from negative levels in 2010 to 9% today and operating profits showing a 17% year-on-year increase. As the return on equity remains half that of US companies, some investors believe that this creates opportunities in Japanese stocks, as they anticipate that the ongoing benefits of the reforms will help narrow this gap.

India’s annual retail inflation eased to 5.1% in January from 5.7% in December, attributed to a slower rise in food prices. Despite inflation exceeding their 4% target, the Reserve Bank of India maintained steady rates, with no immediate cuts expected.

Indian markets surged following better-than-expected GDP data for Q3 of the previous year, showing growth of 8.4% year-on-year. This robust growth allowed India to maintain its position as the world’s fastest-growing economy. The IMF projects India’s economy to expand by 6.5% in 2024, outpacing China’s projected growth of 4.6%.

Additionally, the economy reached a four-month high in January, buoyed by accelerated manufacturing and services growth. Export orders also saw a significant uptick, further contributing to the positive economic outlook.

The price of goods and services in this year’s Chinese New Year celebrations was actually less expensive than last year, as China saw its biggest fall in consumer prices since 2009. The Consumer Price Index (CPI) registered a negative 0.8% year-on-year for January. With the past five months witnessing either stagnant or falling prices, this persistent deflation trend in the Chinese economy raises concerns about the potential for a sustained deflationary cycle to take root in consumer behaviour.

In contrast to many other economies, Chinese policymakers have been reducing interest rates in an effort to stimulate economic growth.

After the approval of Bitcoin ETFs in January, the cryptocurrency surged to its highest level in over two years, fuelled by continued inflows from institutional investors. A substantial $7 billion has already been invested in Bitcoin ETFs.

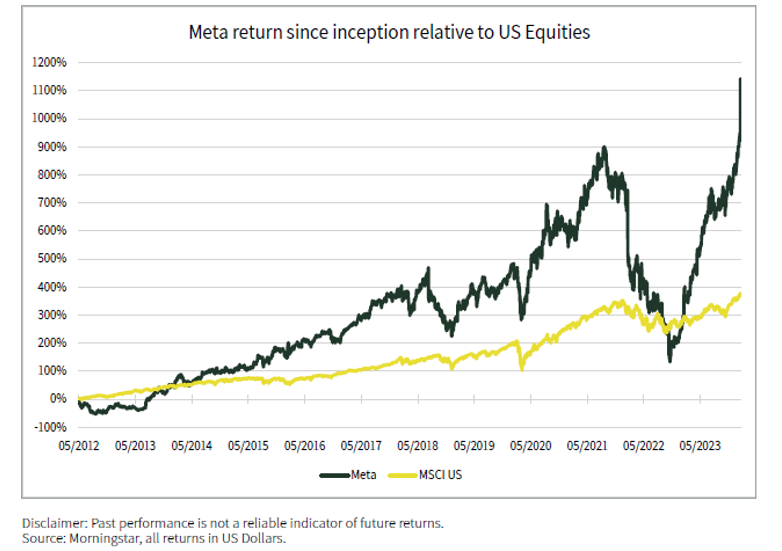

On February 2nd, Meta achieved the largest single-day increase in stock market value of any company in history, soaring by $196 billion. This marked a 20.3% surge, the company’s largest percentage increase in a year and the third-largest since its listing in 2012. The company’s cost-saving initiatives resulted in a 25% rise in revenues, and its announcement of inaugural cash dividends in the fourth quarter of 2023, with intentions to pay quarterly after that, made Meta’s stock more attractive to investors. Additionally, the company’s emphasis on advancing its use of AI technology contributed to its appeal.

Later, on February 22nd, chipmaker Nvidia smashed Meta’s record with a remarkable increase of $277 billion in stock market value. This 16.4% surge was propelled by its quarterly report and optimism surrounding AI’s growth and the demand for Nvidia’s specialised chips in AI computing. Nvidia revealed revenues of $22.1 billion, which exceeded expectations, and an impressive 796% surge in net profit to $12.3 billion. Nvidia’s valuation surpassed $2 trillion, overtaking Amazon and Alphabet to claim the position of the world’s fourth most valuable company. This growth also contributed to a 2% gain in the US markets for the day.

Arm Holdings, another chip manufacturer for AI applications, experienced nearly a doubling of its share price after releasing its earnings estimates for the upcoming fiscal year. Arm, however, differs as it is only partially listed, with a majority of its shares privately owned by Softbank. The gains observed were partially due to illiquidity and short sellers covering their positions.

As a cautionary note regarding overexposure to tech-centric themes, it’s worth noting that Meta also holds the record for the largest single-day stock market loss in history ($200 billion in February 2022). This highlights the importance of not being overly exposed to the volatility of a single company or a few and the significance of maintaining a diversified portfolio.

Investors interested in exposure to the AI theme can explore other aspects of the supply chain, such as “enabler companies” crucial for developing and implementing AI technology. There are attractive entry points into AI-related companies, such as semiconductor manufacturing equipment providers, which have yet to experience the booming recovery seen in later-stage companies. When investing in thematic trends, it is crucial to select not only the right theme but also the right companies within that theme and to have exposure across all facets of the theme’s value chain.

Contact your Investment Advisor to learn more about thematic investing.