July was a quiet month for markets, although US indices did reach record highs. The US has agreed to 15 trade deals following Trump’s tariff threats, and Congress also passed the One Big Beautiful Bill Act, which is forecast to cost more than $3 trillion over the next 10 years.

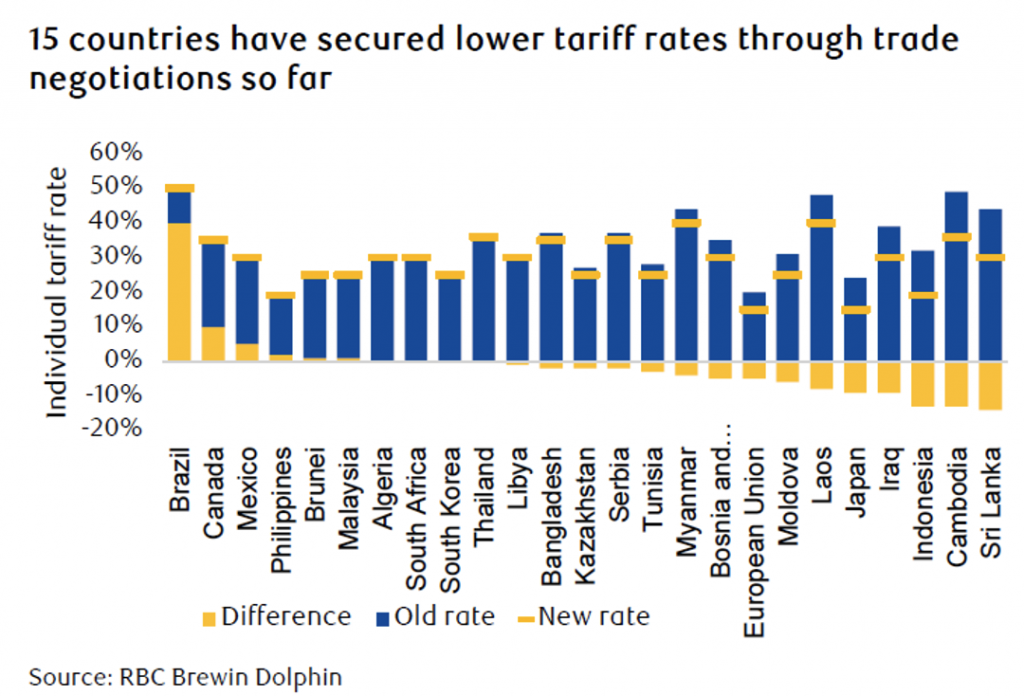

Japan and the EU were both able to secure trade deals with the US at lower tariff rates than had been threatened, albeit still with higher tariffs than before Trump’s return to office. Both are now subject to a 15% baseline tariff. Importantly, cars are not subject to additional tariffs and are included within the baseline rate, which means Japanese and European car manufacturers are not as hampered as they could have been on exporting to the US.

Fifteen countries have agreed to trade deals with the US so far. However, not many have seen large concessions on the originally threatened tariffs. Some countries are still incurring Trump’s ire over non-trade-related issues and are being hit with tariffs. For example, Brazil has seen US tariffs increased to 50% because Trump is unhappy that former Brazilian President Jair Bolsanaro is facing charges over alleged attempts to overturn the results of the previous election, which he lost.

The US has also been negotiating inward investment as part of its trade deals, with Japan and Europe committing to investments of $550 billion and $600 billion, respectively into the country; the EU will also buy $750 billion worth of energy products from the US, which will also help with Europe’s move away from Russian energy.

Markets in the US hit record highs during July as a sense of some apathy over trade negotiations settles in, with most investors waiting to see the results rather than reacting to rhetoric. The impact on inflation will be watched closely, with the Fed likely to hold steady whilst it waits to see the economic effects on the US of the tariffs.

Trump floated the idea, again, of removing Powell, which constitutionally he is unlikely to be able to do. The market did react negatively to this, before rebounding the following day as Trump rowed back on this threat. Trump believes that the Fed should be slashing interest rates in order to help the economy, but the Fed is independent of government and does not want to lower interest rates quickly, with the outlook on inflation uncertain.

In another sign of the tension between the pair, Trump lambasted Powell in front of the press during a tour of the Federal Reserve to see the progress on renovations being carried out there. He accused Powell of running over budget on the renovations. However, Powell promptly denied this when presented with Trump’s “evidence”, as the president had in fact added the costs of building renovations completed some years ago, which were not part of the current budget. The exchange showed in public that all is not harmonious between the pair.

The Senate finally passed the One Big Beautiful Bill Act by a majority of one before the legislation went back to the House of Representatives, where it passed by 218 to 214 votes. The bill has been highly controversial, as it is a sweeping Act that covers many areas. Even some Republicans are on record as having said that they didn’t know everything that they had voted for with this bill.

Trump has used the bill to enact many key agenda points and deliver on some of his campaign promises. The bill extends the tax cuts brought in during his first term, which had been due to expire, by now making them permanent instead of temporary. Taxes on tips, overtime, and Social Security recipients were lifted, which is expected to cost $4.5 trillion over the next 10 years, whilst $150 billion in funding was secured for border security, detention centres, and immigration enforcement officers. Cuts were also made to health services, and tax incentives for clean energy projects were removed.

The market will watch the impact of this bill on the USA, as it brings in reduced tax income and increased spending. Reductions to healthcare and clean energy could also have longer-term effects on the economy.

The Congressional Budget Office estimates that the bill will cost the US economy $3.3 trillion over the next 10 years and leave millions without health coverage.

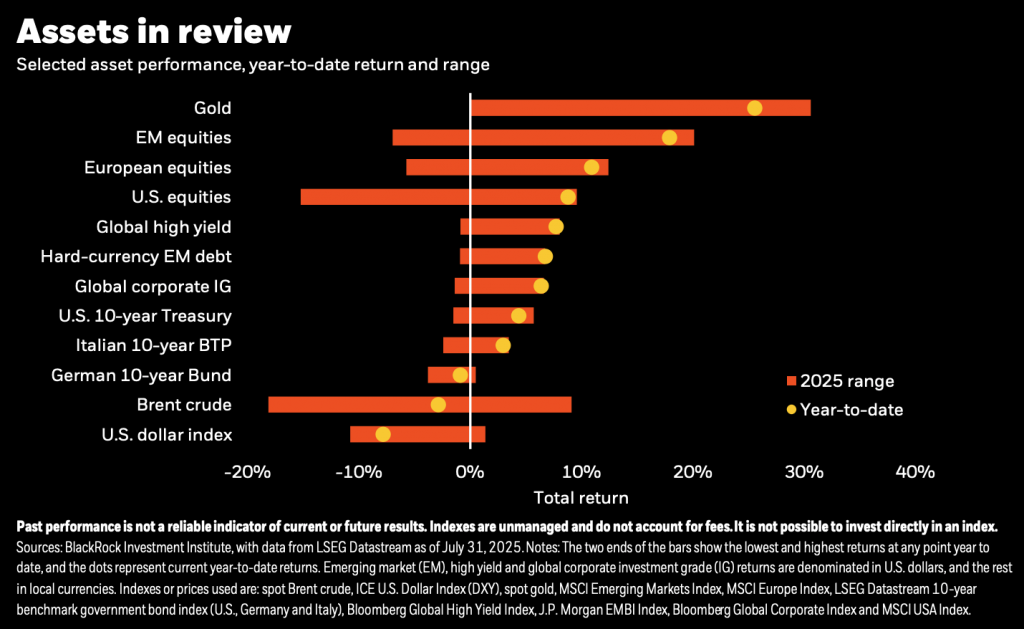

Asset Class Performance Year-To-Date

(As at 4th August 2025)