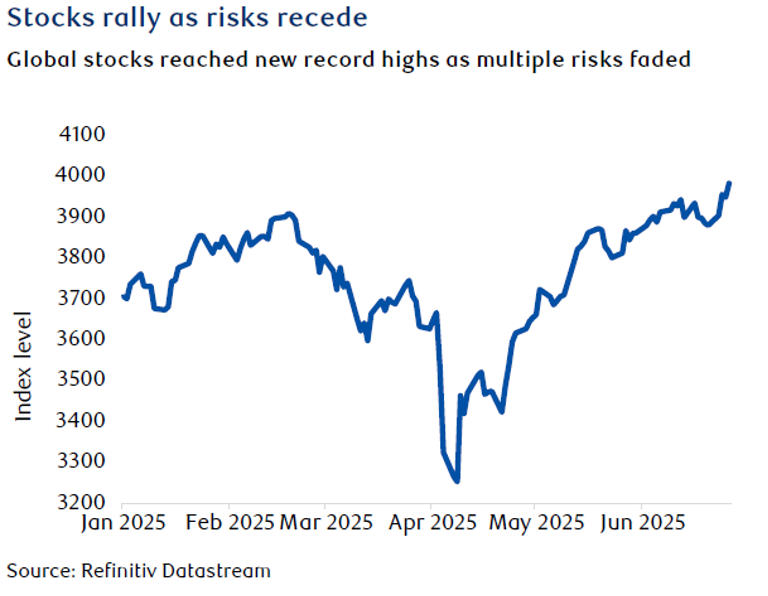

Interest rates were back in focus for June, with a raft of central bank announcements coming. Trade uncertainty remains, but the market has largely ignored the latest announcements from Trump, with trade fears and geopolitical fears receding in the month and leading to new market highs.

The US and China reached a tentative agreement following trade talks in London, with a key objective of the Americans being greater access to rare earths from China. The deal would still see a 55% tariff on Chinese imports into the US. Chinese exports to the US fell significantly year-on-year by 35% in May, whilst their total exports actually increased by 5%, and by 12% to the EU. Global trade is being repositioned by Trump’s tariff policy, and China is looking to benefit from the remainder of the global market. It is a risky strategy from the US, which is increasingly being seen as an unreliable partner, and an opportunity for China to show that it is the safest trading partner to work with.

Trump announced that he had pulled out of trade talks with Canada due to its digital services tax, which would affect US technology companies, which were introduced last year and applied retrospectively to 2022.

The market largely ignored this, with many investors now accustomed to Trump’s tactics. He is seen as someone who will delay, extend deadlines, and provide exemptions just to ensure that he can announce a deal. He has earned the nickname “DJ TACO” on Wall Street – “Trump Always Chickens Out” – and many investors are playing the TACO trade. This is why, despite this announcement, the S&P 500 and Nasdaq still both finished the month at record highs.

The World Bank cut its global growth forecast for the year to 2.3%, down from 2.7% in January, due to the impact of tariffs on global trade. It is also revised down its growth projections for the US, to 1.4% from 2.3%, also warning that “without a swift course correction, the harm to living standards could be deep”.

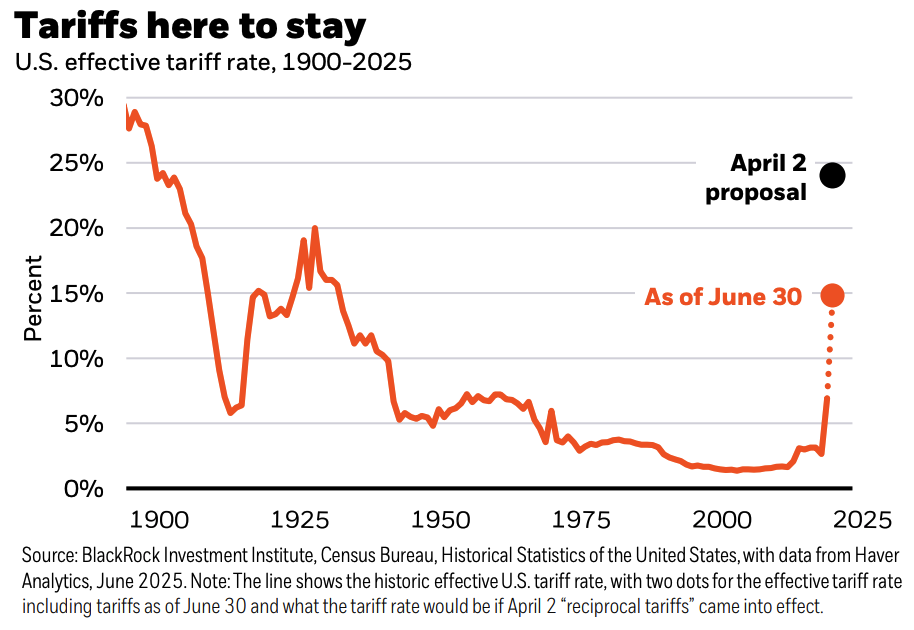

Trump seems unlikely to back down on his tariff policy, but his continual whipsawing leads to uncertainty as to what the severity of the global impact will be. If he continues with the “TACO” approach, then tariffs will remain higher than in previous years, but it also shows that he is more flexible than his rhetoric suggests. Global supply chains can’t be changed quickly, which leads to exemptions for certain industries. The bond market for US debt relies heavily on foreign investors, which is why the previous 90-day extension was brought in as yields rose sharply. The US effective tariff rate has risen and could increase further, but doesn’t appear, for now, to be heading as high as it was forecast to with the “Liberation Day” announcement.

Interest rates were back in the news in June, with a raft of central bank decisions being made, and President Trump continuing his tirade against his own appointee to the Chair of the Fed, Jay Powell.

The Bank of England held its main interest rate at 4.25%, with the latest figures for the UK showing inflation remaining high at 3.4%.

The Bank of Japan maintained its main rate at 0.5%, opting not to raise it further. After struggling with deflation for decades, Japan now has the highest inflation rate in the G7 at 3.7%. The Bank did decide to slow down its bond-buying programme, which it said would “allow yields to move more freely under market forces”.

The ECB cut rates by a further 25 basis points to 2%, with its annual inflation for May coming in at 1.9%, which is below the bank’s 2% target. The Swiss central bank cut its interest rates to zero, as it tries to deal with a surge in the value of the Swiss franc, which investors have flocked to as a safe-haven asset during this period of global trade tension.

The Reserve Bank of India also cut rates, but by a more-than-expected 0.5%, bringing the rate to a three-year low of 5.5%.

In the US, Trump wants the Fed to cut interest rates by a full percentage point, which he believes would stimulate economic growth. The Fed’s position has been to wait and see the impact of tariffs on inflation before making any decision on further rate cuts, and it has signalled for some time that it prefers to be patient. US inflation rose slightly in May to 2.4%, but there is little evidence that the higher cost of imported goods, due to tariffs, has yet been passed on to consumers. So far, businesses have stockpiled ahead of the largest tariffs and have been able to either sell existing inventory without raising prices or absorb the price rises they have faced so far. Economists expect this to change in the coming months, with the tariffs potentially adding around 1.5% to US inflation.

The Trump administration has used a weakening labour market as another reason for a rate cut to happen, with the average number of job gains per month for the year to May being 124,000, which is lower than the 168,000 average from the same period in 2024.

The Fed decided again to leave its benchmark rate unchanged at 4.25% to 4.5%. It also lowered its growth estimate for the US economy for the year to 1.4% and raised its unemployment forecast. The Fed’s dot plot still suggests two rate cuts to come this year, and Powell expects tariffs to raise prices, although the impact of this and how long it might last remain “highly uncertain”. Powell suggested to Congress that September would be the earliest to expect a rate cut.

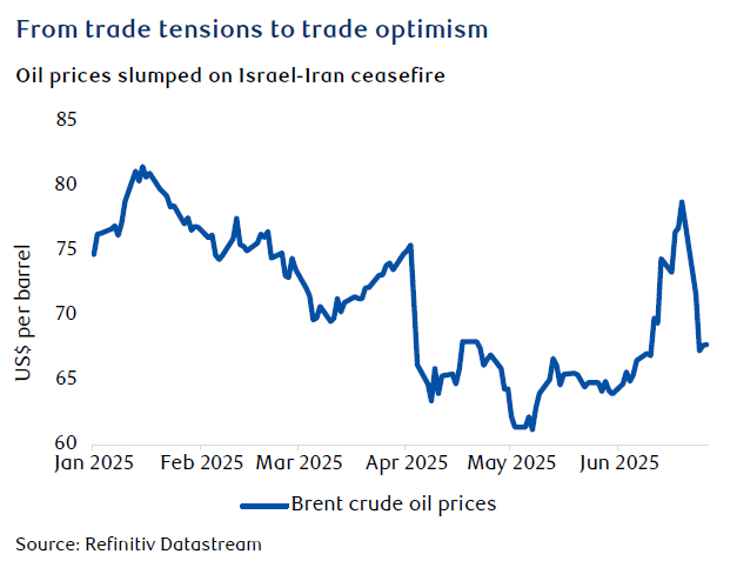

OPEC+ agreed on a third consecutive month of production increases by announcing a 411,000 barrels per day uplift for July. Previous cuts had failed to increase the price, with oil down 13% for the year before the exchange of missiles between Israel and Iran, which saw the biggest intraday increase in oil futures since the Russian invasion of Ukraine in February 2022. Oil finished a volatile month roughly where it started, with prices dropping again as the threat of an Iranian blockade in the Strait of Hormuz decreased.

Safe haven assets have been in strong demand, with central banks across the world now believed to be holding almost as much gold as they did in 1965. This would mean that gold replaced the euro as the second-largest store of value after the US dollar.

The Abu Dhabi National Oil Company (ADNOC) has led a consortium to buy the Australian energy exploration company and natural gas supplier Santos, with an offer of $19 billion. If the bid is accepted, it will be the largest-ever takeover of an Australian company.

Nvidia’s share price hit a new record high, the first time it has done so this year. The company hit a market cap of nearly $3.8 trillion, becoming the world’s most valuable company.