Markets saw a modest gain in June, continuing the positive growth of 2024, albeit at a slower pace than earlier in the year. The MSCI World Index increased by 1.9%, with US markets hitting all-time highs.

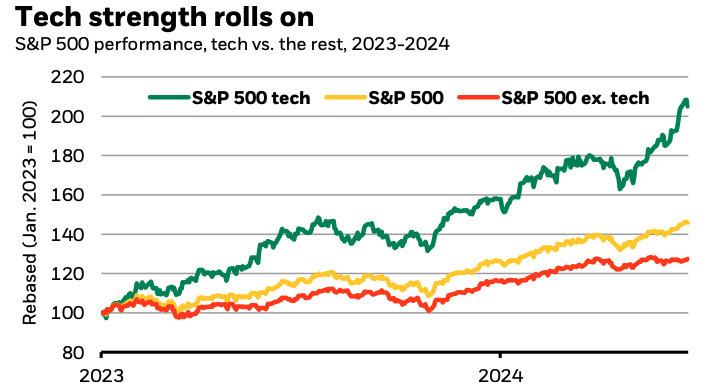

Tech stocks have continued to be the biggest driver of market growth, while inflation is slowing further, boosting hopes of rate cuts later this year.

This month, we look at US markets, interest rate cuts starting to come in across developed economies, and the latest on select elections across the world.

The S&P 500 finished the first half of the year with a 14% gain. However, 60% of this was driven by just five mega-cap stocks in Nvidia, Microsoft, Amazon, Meta, and Apple, all boosted by the frenzy over the potential for generative AI. The second quarter saw the market rally narrow compared to the first, with Nvidia, Apple, and Microsoft accounting for 90% of the index gains in this period. Each company is now worth over $3 trillion. Nvidia briefly overtook Apple and Microsoft to move from the world’s third most valuable company to the most valuable outright, with its market capitalisation surpassing $3.3 trillion. Amazon’s market cap also reached $2 trillion for the first time.

If the S&P 500 had all of its constituent stocks equal-weighted, the index would only have gained 4% in H1, and Q2 would have seen a decline.

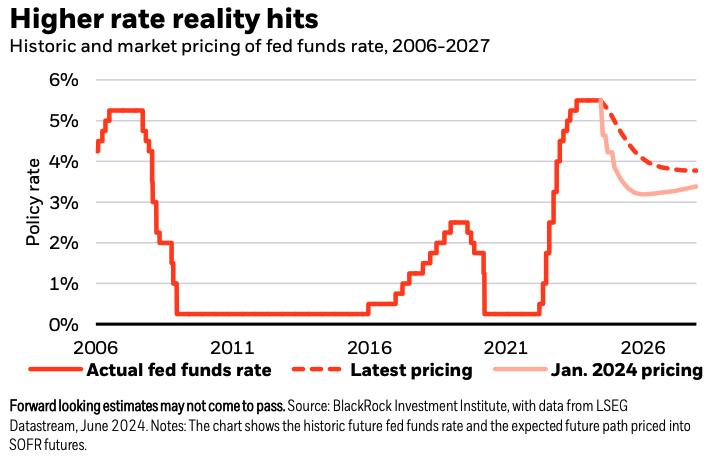

The Bank of Canada was the first G7 central bank to cut interest rates, lowering its benchmark rate from 5% to 4.75%. Soon after, the ECB followed suit with its own 25 basis point reduction to bring its base rate down to 3.75%. The ECB move was as the market had expected. However, there were upward revisions to both headline and core inflation for the rest of this year and into 2025, with price pressures coming from supply chain disruption and surges in energy prices.

The Bank of England left its interest rate unchanged at 5.25%, despite headline annual inflation hitting having now fallen to the 2% target in May, down from 2.3% in April. The Bank described the decision as “finely balanced” since core inflation remained higher than target at 3.5% – although this is down from 3.9% the month before – and services inflation did not fall as much as expected, at 5.7% from 5.9% in April. Governor Andrew Bailey hailed it as “good news” that inflation was at the 2% target but was too early to cut rates, emphasising the need to keep inflation low. Markets have priced in a 44% probability of a cut in August and a 90% probability in September.

In the US, comments from Fed official caused no surprises, with the New York Fed President saying that rates will gradually come down, and the Richmond Fed President saying he required more months of economic data before supporting a rate cut. The personal consumption expenditures index, which is the Fed’s preferred measure of inflation, fell to 2.6% from a year ago in May, its lowest annual rate in more than three years.

Elsewhere, the Swiss National Bank reduced its main rate by 25 basis points to 1.25% following a similar move in March, and the Norwegian central bank left its benchmark rate unchanged at a 16-year high of 4.5%.

India’s stock market experienced volatility following election results, which revealed that current Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) had lost its majority when many had expected it to increase, meaning it will now need to rule in coalition with other parties. The BSE Sensex fell 6% on the news, with investors fearing that it would be more difficult for Modi to continue pushing his agenda for economic reforms. Some analysts expect India’s long-term story to remain compelling despite the short-term volatility.

The Mexican presidential election also saw a different result than anticipated, with Claudia Sheinbaum winning the presidency by a larger-than-expected margin. Mexican share prices fell as investors worried that her majority would allow her to roll out reforms that could erode checks and balances. However, the continuation of the ruling coalition in government could point to stability.

Elections for the European Parliament saw a surge in votes for right-wing and populist parties across the EU, although centrist parties will maintain a majority and control. In France, the performance of Marine Le Pen’s right-wing National Rally party caused President Macron to call a snap general election, to the great surprise of many. The first round of voting saw National Rally win the largest vote share of the three major parties, although the French system means many seats will go to a run-off as candidates must win more than 50% of the vote to gain the seat.

In the UK, Prime Minister Rishi Sunak and Labour Party leader Keir Starmer held their first TV debate to outline their vision for the country’s economic future ahead of the July 4th general election. Opinion polls suggest that the Labour Party holds a commanding lead among voters, and many expect them to oust the incumbent Conservative Party in government.

The US job market continues to run hot, with a higher-than-expected 272,000 jobs added in May, although the unemployment rate also rose from 3.9% to 4%, its highest since January 2022.

The US Federal Reserve released the results of its annual stress tests, which assess how banks would cope with a severe global recession and property market collapse. All 31 banks passed the tests and would meet their minimum capital ratios.

The Japanese yen fell to a 40-year low of JPY 160 against the US dollar. Despite interventions worth billions of dollars by the finance ministry, the wide gap between interest rates on the yen and the dollar has seen the currency continue to fall. The BoJ indicated that its July quantitative tightening plan may exceed market expectations and could include an interest rate hike, which marks a significant step in its gradual withdrawal from extensive monetary stimulus efforts.

Indian government bonds will appear in the JPMorgan Government Bond Index (Emerging Markets) for the first time in July. The inclusion will be staggered from an initial 1% to a maximum of 10% by April 2025, which is expected to bring inflows of up to $40 billion.

OPEC+ agreed to extend cuts to oil production to maintain prices in the face of weakening global demand. They had agreed to cut production by 5.9 million barrels per day in 2024, which equates to 5.7% of global demand, and cuts will continue into 2025.