The S&P 500 closed at a record high 22 times during the first quarter for a total gain of more than 10%. The MSCI World Index also grew 3.3% in March for a total quarterly gain of 8.47%.

Markets were subdued for the beginning of March, with an eye to inflation data and central bank policy decisions, but ended the month optimistic of rate cuts to come later this year, even if fewer in number than had been hoped for in last year’s projections.

The S&P 500 recorded its best Q1 since 2019 with a 10% rise, driven by the excitement around AI and expectations that the Fed will soon start reducing interest rates.

Jay Powell, chair of the Fed, presented the semi-annual Monetary Policy Report to Congress, stating that he believed the Fed were in the right place with its current position on interest rates. He said the central bank was close to having the confidence it needs in inflation falling to start cutting interest rates but confirmed that a key concern for the Fed was not to cause job losses by cutting rates too soon. However, the data suggests that the labour market remains strong – the US economy added a better-than-expected 275,00 jobs in February.

Inflation, however, remains stubbornly high. The US’s annual CPI rose slightly in February to 3.2%, with a monthly gain of 0.4% in line with expectations. Core CPI rose to 3.8% year-on-year, and the producer price index (pipeline costs for producers) also rose higher than expected, by 0.6% for the month and 1.6% annualised, which was its biggest increase since September.

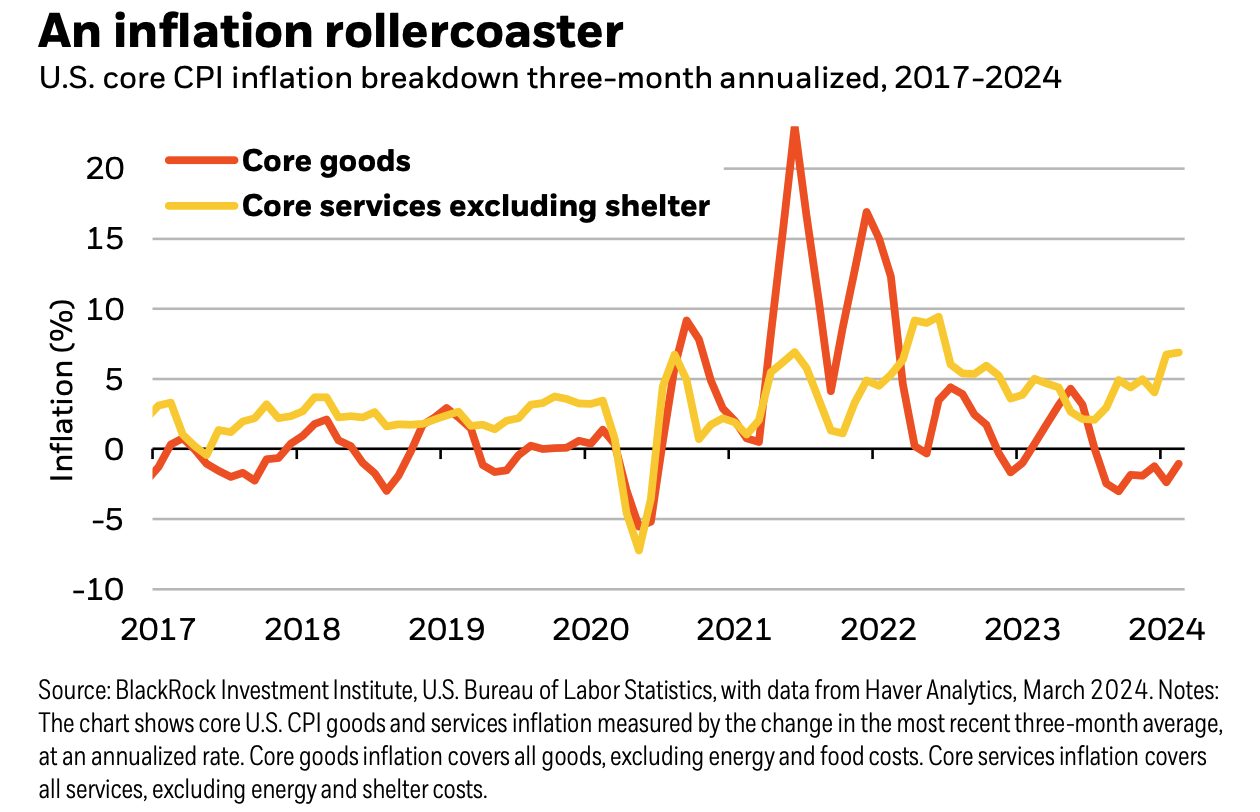

Core goods inflation has been helping to bring headline inflation down, but recently, there has been a spike in core services inflation, with a strong labour market and rising wages contributing to this. However, this may be a temporary uptick at the beginning of the year as it is when most companies would put up their prices and wages.

The Fed left interest rates unchanged at 5.25% to 5.5%, and the latest dot plot suggested three 0.25% cuts by the end of this year, in line with bond market expectations.

However, the size of US debt remains a concern to some, with the director of the Congressional Budget Office warning of a debt crisis due to federal debt standing at $26 trillion, which is 97% of GDP.

In politics, Republican and Democrat primary races confirmed that it will be between Donald Trump and Joe Biden in November’s presidential election. Super Tuesday, where the largest number of states hold their primaries and caucuses, saw Trump emerge as the clear frontrunner for the Republican nomination ahead of his closest challenger, Nikki Hayley. Joe Biden received the Democratic nomination against no credible opposition.

Trump Media, which owns Donald Trump’s social networking site Truth Social, debuted on the Nasdaq as the former President tries to raise capital to pay penalties in his recently lost defamation case and be able to post bond during his appeal against his and his company’s conviction of business fraud in New York. In early trading, its value soared to $9 billion despite the company losing $49 million in 2023. Trump owns just over half of the shares, but he cannot sell them for six months following the listing due to the conditions of his ownership.

Chancellor of the Exchequer, Jeremy Hunt, unveiled the Spring Budget. One big announcement was a further reduction to national insurance, with an additional two percentage point reduction following the same in the last Autumn Budget: national insurance has now gone down from 12% last year to 6% from the 6th of April onwards. The move is estimated to cost the government £10 billion. Financial markets were unmoved by the Budget, with most big announcements already being announced or leaked, and many saw them as just an attempt to close the poll gap to the opposition Labour Party ahead of a general election later this year.

UK inflation fell to 3.4% in February from 4% in January, but the Bank of England kept interest rates unchanged.

The Bank of Japan raised interest rates for the first time in 17 years, ending the world’s last negative interest policy. The central bank rate is now between 0% and 0.1%, and the yield curve control policy was also removed. The BoJ’s governor said that the bank will maintain “accommodative financial conditions” and continue buying $40 million of government bonds per month.

Most commentators believe this is a one-and-done interest rate hike, although money markets are expecting two more later this year. The BoJ has been clear in its messaging that this rate hike is about normalising policy and not about anxiety over inflation.

The ECB left interest rates unchanged again at their record high of 4%, where they have been since September. Despite no rate cut, there was an acknowledgement that inflation was falling faster than expected, and policymakers are admitting that only the timing of a rate cut is up for debate, with some analysts expecting it to come in June.

The risk for the ECB is that whilst underlying measures of inflation are easing, domestic price pressures remain high in some countries and wage growth is strong. Higher wage growth is a driver of inflation, and services inflation, which is more sensitive to wage price growth, has been running well above target for months; goods prices have been responsible for most of the fall in headline inflation.

Dubai-based parking operator Parkin became the first UAE firm to publicly list this year and the sixth since 2021. Shares surged 30% on debut. There have been many IPOs across the Gulf recently, with 35 last year, of which eight were in the UAE. Dubai’s public listing drive has continued with Parkin, and investors will be keen to see what the future holds for IPOs in Dubai.

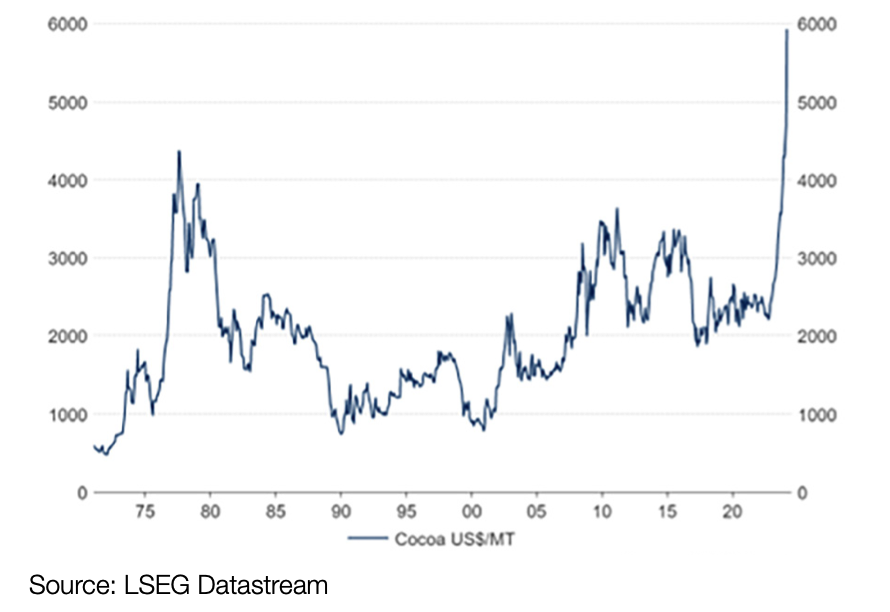

The price of cocoa shot up rapidly this year due to dry weather in West Africa, which has led to supply shortages. Increased fertiliser prices due to the war in Ukraine have also contributed to the rise.

It has been one of the best-performing assets anywhere in the world this year, and we have access to a trend-following strategy that has taken advantage of rising cocoa prices, among other factors, to have returned more than 20% year-to-date. Its average annual returns over the last ten years have been stellar, at 23%+. To learn how to gain exposure to this, please speak with your Financial Planner.