This month’s market update focuses exclusively on tariffs, which have been the driving factor behind a market decline over the past several weeks, particularly in the US, where both the S&P 500 and Nasdaq indices have fallen into correction territory.

Please note all insights in this update cover developments up to March 25th. Any end-of-month updates will feature in our April commentary.

Donald Trump last year described ‘tariff’ as “the most beautiful word in the dictionary”. Whether you agree with him or not, there can be no doubt that it is one of the most important words in the dictionary this year, as markets continued to be roiled by the Trump Administration’s sweeping imposition of tariffs on key allies and trading partners. Despite some delays, including on some imports from Canada and Mexico until April 2nd, Trump’s pushing ahead with starting a trade war has rattled markets. The S&P 500 fell into correction territory over a 16-day period, meaning it has fallen more than 10% from its previous high, and the Fed has held interest rates steady due to the uncertainty over how a trade war will hurt the US economy.

Levies on aluminium and steel were not included in the delay, and Trump said that carmakers would not be exempt from tariffs after the April deadline. This is a particularly contentious area, as car manufacturing in North America sees parts regularly transported between Canada, Mexico, and the US as part of the production line.

Tariffs on steel and aluminium are of particular significance, as all imports of these metals from all countries will be subject to a new 25% tariff.

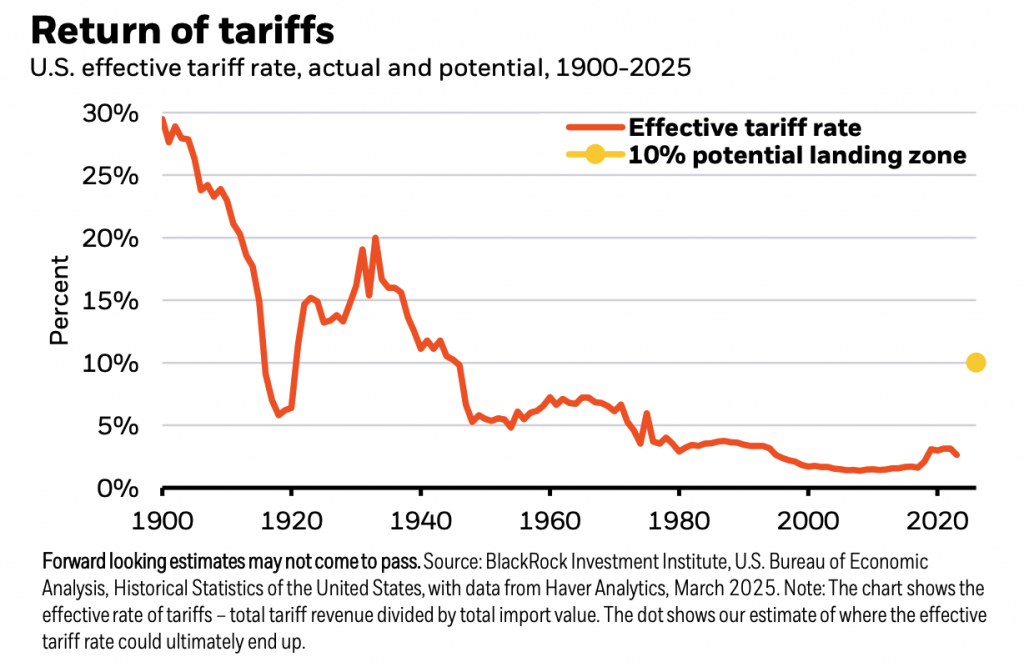

It remains to be seen how the final set of tariffs will shake out, with plenty of exemptions, deferrals, and some increases coming from the White House. No one is quite sure where Trump will land on his tariff decisions, and this is not helped by his ire at countries retaliating, which he sees as unfair behaviour (despite his starting the trade war). So far, the total effective rate of tariffs is the largest the US has rolled out in almost a century.

The response from Canada has been strong, with plenty of anger felt there over Trump’s comments on making Canada the 51st state of the USA. Not only has the country responded with tariffs on $21 billion of US goods, but there have also been threats from Ontario to cut off the electricity supply to some northern US states (a tariff has been imposed), crowds have booed the US national anthem at sporting events, and shops have been taking US products off the shelves (particularly alcohol) in favour of a ‘Made in Canada’ selection.

Canada’s central bank has said that uncertainty over trade was already hurting investment in Canada, saying that the tariffs were a “new crisis” for the country.

Mark Carney, the former Governor of the Bank of England, won the Liberal Party’s leadership contest to replace the outgoing Prime Minister Justin Trudeau and will lead the party in the upcoming Canadian general election. Focus in the election has switched to how to deal with Trump, with all party leaders looking to show strength in the face of a trade war.

The EU has responded with tariffs on several symbolic US imports, such as up to 50% levies on bourbon whiskey and Harley-Davidson motorcycles. The total EU response targets €26 billion worth of imports.

The US increased its tariffs on Chinese imports from 10% to 20%, in addition to the import duties Chinese goods are already subject to, and China’s foreign minister, Wang Yi, responded by accusing America of using the “law of the jungle”. China’s retaliation was to introduce tariffs of 10-15% on US agricultural imports.

The uncertainty has led to fears over global economic growth and has seen oil prices fall to three-year lows, whilst gold has surpassed $3,000/oz for the first time.

China set an annual growth target of 5% for 2025. Meanwhile, its consumer price index fell by 0.7% year-on-year in February, the first time it was negative since January 2024.

The ECB cut interest rates by a further 25 basis points, taking the base rate down to 2.5%.

Northvolt, the Swedish battery maker and one-time best-funded startup in Europe filed for bankruptcy after failing to agree on a new financing package with investors.