This month contains an in-depth look at the points of the recent UK Budget which are likely to affect our clients. We also summarise another good month for US markets and economic data, the latest on the stimulus packages in China, and round-up other market news.

The new Labour government had its first opportunity to lay out its tax and spending plans in its first budget. Chancellor Rachel Reeves had been seeking to fill what she described as a “£22 billion black hole” in public finances via tax increases and budget cuts. During the election, Labour had made a manifesto promise not to raise taxes or National Insurance on “working people”. However, it did not provide a solid definition for the term. The most controversial budget announcement in this regard was the increase in employers’ National Insurance contributions. The previous government had cut NI for employees, in a move which most economists agreed was not sensible, and this government had backed itself into a corner on not being able to reverse this. Therefore, the workaround won’t directly hit employees. However, wage growth is expected to be slower due to increased costs for businesses.

The Office for Budget Responsibility (OBR) also released its forecast, which contained a statement saying that previous forecasts would have been “materially different” had it been provided with full information from the previous government, which highlights the difficult position of the new government with regards to public finances, which were worse than they had expected them to be whilst in opposition (although some of the overspend should have been noticeable to them).

This update won’t cover the full budget, but the key points to international investors are summarised below:

Changes to Capital Gains Tax, Stamp Duty, and Inheritance Tax are the most important to note. The below is our summary and should not be considered as tax advice. We recommend speaking to a qualified tax advisor about your individual circumstances.

CGT rates going up will affect investors with UK property when they sell, as the rates have increased. This, along with lowering the personal exempt amount, will lead to a larger tax liability. Investors purchasing a second property will also see a larger surcharge on stamp duty. Anyone who has already exchanged contracts will not be subject to the new, increased surcharge, but future investments are immediately liable for the increase.

Investors may wish to jointly own property with their spouses to reduce the tax liability, or for those who fall into the higher rate taxpayer banding through ownership of multiple properties may consider if there are any benefits to them from owning companies via a limited company. The increase in personal tax thresholds will benefit the income tax on rental income from April 2028.

Despite the changes, the UK property market remains full of great investment opportunities, which we recommend you discuss with your advisor.

Inheritance tax is something which affects all British-domiciled individuals. Currently, your domicile determines your IHT liability on death, not your residence. The changes to IHT are fairly complex, and we have yet to see the full details, but there will be significant changes to the current regime. The nil-rate bands being frozen until 2030 will see more people fall into the IHT net as their assets rise in value over the next five or six years.

The changing of rules on domicile and residence will also make an impact, although potentially for the better, depending on your individual circumstances. The non-dom regime change to a residency-based system is designed for non-doms coming to the UK and remitting income there (expectations are that there will be no tax for four years, and then a sliding scale will be introduced).

The residency system will also apply to IHT. “Long-term residents” – those who have been resident in the UK for at least 10 of the last 20 tax years – will be subject to IHT on their worldwide assets. Therefore, long-term expats are set to benefit from this change. UK situs assets (e.g., UK property or UK shares) will remain liable to IHT regardless of residence.

The biggest change to IHT planning is that unused amounts in pensions will be subject to IHT. Under the residency test, a UK SIPP will be regarded as a UK situs asset. Pensions were previously outside of someone’s estate for IHT, but this will change from April 2027. The government’s reasoning for this is that pensions are designed to provide a retirement income and receive plenty of tax relief on the contributions. By funding pensions but not using them for retirement, the government believes that people are not using them for their intended purpose and exploiting a loophole to avoid tax (both on income tax relief and IHT exemption on death). Whilst, of course, there has been nothing wrong with using a pension to mitigate IHT previously, this will now change from April 2027. Therefore, anyone who has set up a pension for the purposes of IHT planning should review their plans.

Pensions are the biggest change to IHT concerns, although the residency test will likely benefit international clients. We recommend a review of your IHT planning with your advisor to ensure that you and your beneficiaries are sufficiently prepared for the new rules. We also recommend seeking qualified tax advice to understand how the changes affect your individual circumstances.

September jobs data exceeded expectations, with 254,000 jobs added, which was the highest monthly gain since March. Numbers for July and August were also revised upwards, and markets saw this as a positive underlying the economy’s resilience, which grew at 2.8% annualised in the third quarter. The Fed is now expected to move at a more measured pace of interest rate cuts, with a 0.25% reduction likely in November following the 0.5% cut in September.

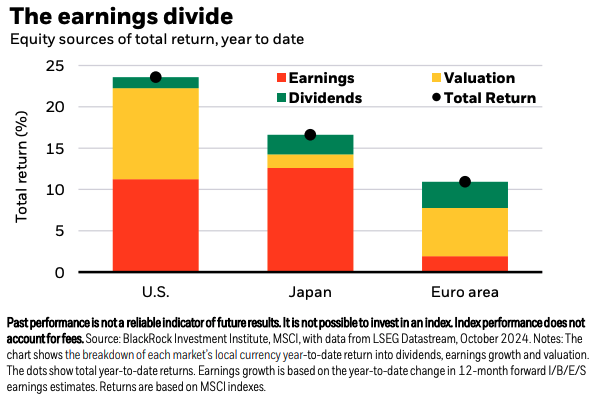

Annual CPI was its lowest since February 2012, falling to 2.4% in September from 2.5% in August. However, this was still slightly higher than had been forecast. Earnings growth for the third quarter is set to be 5%, slightly above expectations of 4%. Earnings growth for the year is expected to be 9%, which would significantly improve last year’s 1% growth rate.

Tuesday, November 5th, saw Americans go to the polls in the presidential election. At the time of this commentary, polling data was neck-and-neck between Harris and Trump, particularly in the seven key swing states of Pennsylvania, Michigan, Wisconsin, North Carolina, Georgia, Arizona, and Nevada. These states hold important electoral college votes and campaigning has been heavily focused here. Markets so far have been agnostic on the election, instead focusing on inflation and interest rates. This may change following the outcome, although historically, markets have always risen between election day and inauguration day. In 2020, US networks did not call the election until the Saturday after voting day. So, there may be a few days following the 5th before we know the final result.

Following the Chinese government’s stimulus package at the end of September, Chinese markets rallied strongly, with the Shanghai Composite having its biggest weekly gain (21%) since 1996 and the Hang Seng Index in Hong Kong rising to a 33% gain for the year.

China’s economy grew faster than expected in the year to the third quarter at 4.6%, but it was the slowest pace of growth since early 2023 and below the government’s target of 5%. The World Bank forecasts that China’s economy will grow by 4.8% this year.

Below target growth and six consecutive quarters of deflation highlight why the government has been introducing stimulus measures.

Days after the EU voted on tariffs for Chinese EVs, China imposed its own temporary anti-dumping tariffs of up to 39% on European brandy imports, saying that foreign distillers threaten its domestic industry.

Conflict in the Middle East drove the price of Brent crude back above $75 per barrel, although the commodity had lost 17% over the third quarter.

Nvidia’s share price hit a new record high, with its market cap surpassing $3.4 trillion. The Dow Jones and S&P 500 also posted their sixth consecutive week of gains to reach new record highs before tempering slightly as investors become nervous over how high mega-cap tech stocks have risen. Alphabet, Microsoft and Meta all posted strong earnings and saw their share prices increase further.

Gold prices reached a new record of nearly $2,750 per ounce, as demand for the safe haven asset has seen its value rise by over 32% this year.

The IMF believes that the “lack of business dynamism” in Europe will widen the GDP gap between Europe and the US. The eurozone economy grew 0.4% in Q3, whilst inflation rose to 2% in October from 1.7% in September.

The ECB cut interest rates again by a further 0.25% to 3.25%.

UK inflation fell to 1.7% in September, its lowest since April 2021. Markets expect the Bank of England to cut interest rates in November.

The Tokyo Stock Exchange hosted its biggest IPO since 2018 with the listing of Tokyo Metro. The company raised $2.3 billion and saw its share price increase by 45% on its first day of trading.

Chinese EV manufacturer BYD overtook Tesla for the first time in quarterly revenue, with $28 billion worth of sales in Q3.