Whilst growth stocks defined the early parts of the year, the third quarter saw a rotation into value. Lower risk was in favour again early in September, when we saw almost a repeat of early August, with markets dropping off. The end of the month saw markets rise again to give another positive month and a positive quarter, albeit with slower growth than in Q1 and Q2.

September began in a similar vein to August, with the MSCI World Index falling 3.9% in the first week of the month and the S&P 500 dropping 4.3% for its worst weekly performance since March 2023. Nvidia also saw the biggest ever single-day decline for a US company, losing $279 billion from its market cap.

However, unlike August, there was no heightened volatility, and markets quickly returned to growth, with the World Index returning 1.69% for the month as a whole. Investors were looking to profit take early in the month, but positive sentiment returned following strong earnings reports and, importantly, the Fed choosing to cut interest rates. September has historically been a difficult month for stock markets, as has October, so the reasonable growth for the month should serve as comfort for investors.

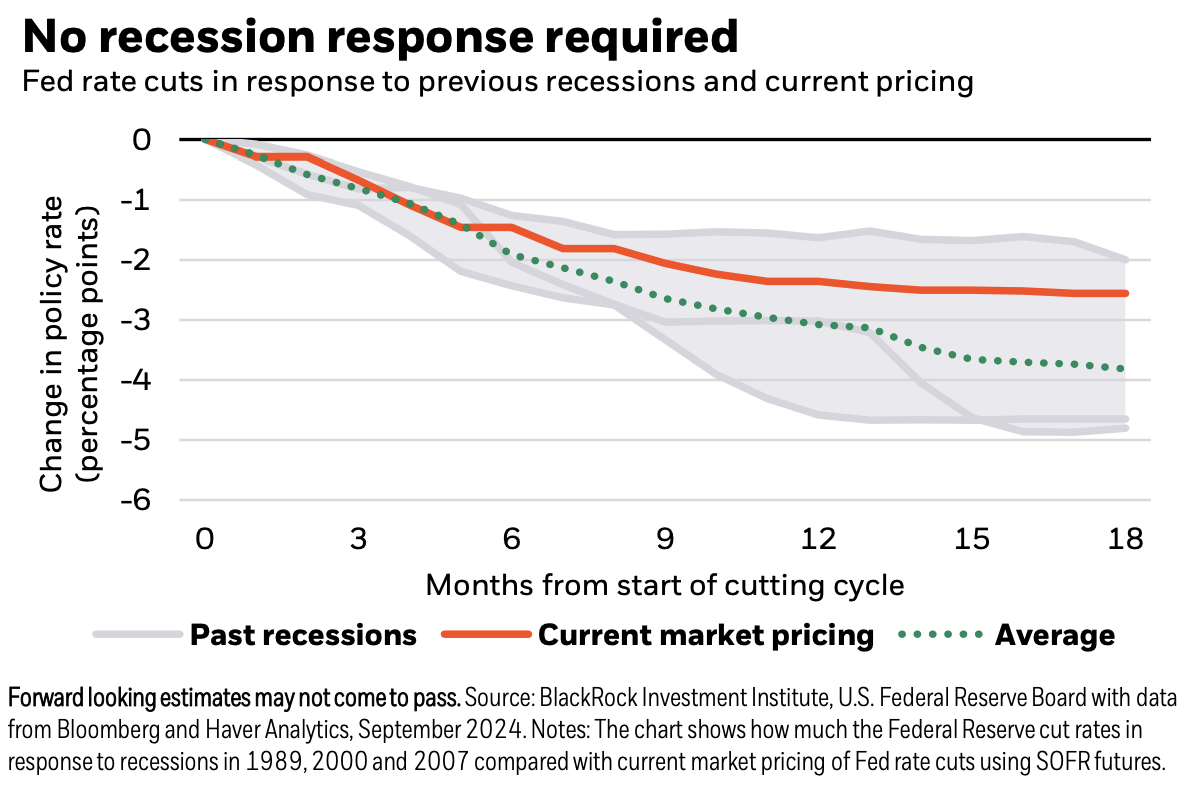

The Fed cut interest rates for the first time in four years, marking what markets hope will be the start of more easing, which they have anticipated for most of the year. The Fed opted to cut by 50 basis points, a larger cut than had previously been predicted. While saying that they are not reacting to catch up to other central banks or are in a rush to loosen further, the size of the cut suggests that they are looking to get ahead of any slowdown that would be detrimental to the US economy. Chair Jay Powell called the move a “recalibration” following the sharp decline in inflation since last year, noting that the economy remained strong. The markets reacted well to the cut and the increased chances of the Fed achieving its much-desired “soft landing”.

Elsewhere in the US, job data released for August was broadly in line with expectations, however, there were significant downward revisions to June and July, and unemployment dropped by 10bps to 4.2%, leading some to believe that companies are reducing job vacancies rather than laying off employees.

The PBOC announced a raft of measures to boost their stock markets and support the property market. The policy interest rate was cut by 0.2% and reduced rates on existing mortgages by 0.5%. They also reduced reserve requirements for banks, which is expected to free up approximately 1 trillion yuan (£106 billion) for new lending.

The biggest stimulus package since the pandemic aims to pull the economy out of deflation and back towards the government’s 5% annual GDP growth target, which it looks set to miss. Data over the last year has pointed to structural weaknesses in the Chinese economy, with foreign investors wary and citizens concerned. Given that this year is the 75th anniversary of the Chinese Communist Party, the authorities are determined to paint a positive picture of the economy.

The measures provided a much-needed boost to markets, with mainland and Hong Kong indices surging in value following the announcement. Large-cap Chinese stocks had their biggest weekly rise since 2008.

Foreign direct investment into China was at a record low in Q2, with investors pulling out $14.8 billion in the quarter. If the decline remains for the rest of the year, it would be the first annual net outflow since 1990.

Elsewhere in China, the country pledged $50 billion to support infrastructure projects in Africa over the next three years, eliminate tariffs on products from 33 African countries, and report Canada to the WTO over their announcement of 100% tariffs on the import of Chinese electric vehicles.

Geopolitics have been firmly in the spotlight of the market this year, and two areas in particular have been under close attention: the conflict between Israel and Hamas and the upcoming US presidential election.

Israel launched a surprise attack on Hezbollah in Lebanon by remotely detonating compromised pagers and walkie-talkies used by the group. This was in response to their rocket attacks in northern Israel, which they have said to be in support of Hamas. Since then, Israel has launched a ground invasion into Lebanon and conducted air strikes against Hezbollah commanders. Iran also launched a ballistic missile attack on Israel in support of Hezbollah. These incidents have escalated tensions in the region, with the prospect of wider war becoming more of a concern. As far as markets are concerned, the recent events did not move the needle. Attacks on shipping by the Iranian-back Houthis have been more of a concern for investors, with traffic through the Suez Canal reducing as ships take the less risky but longer route around the Cape of Good Hope, increasing costs and contributing to inflation. This highlights how conflict has an impact on the global economy.

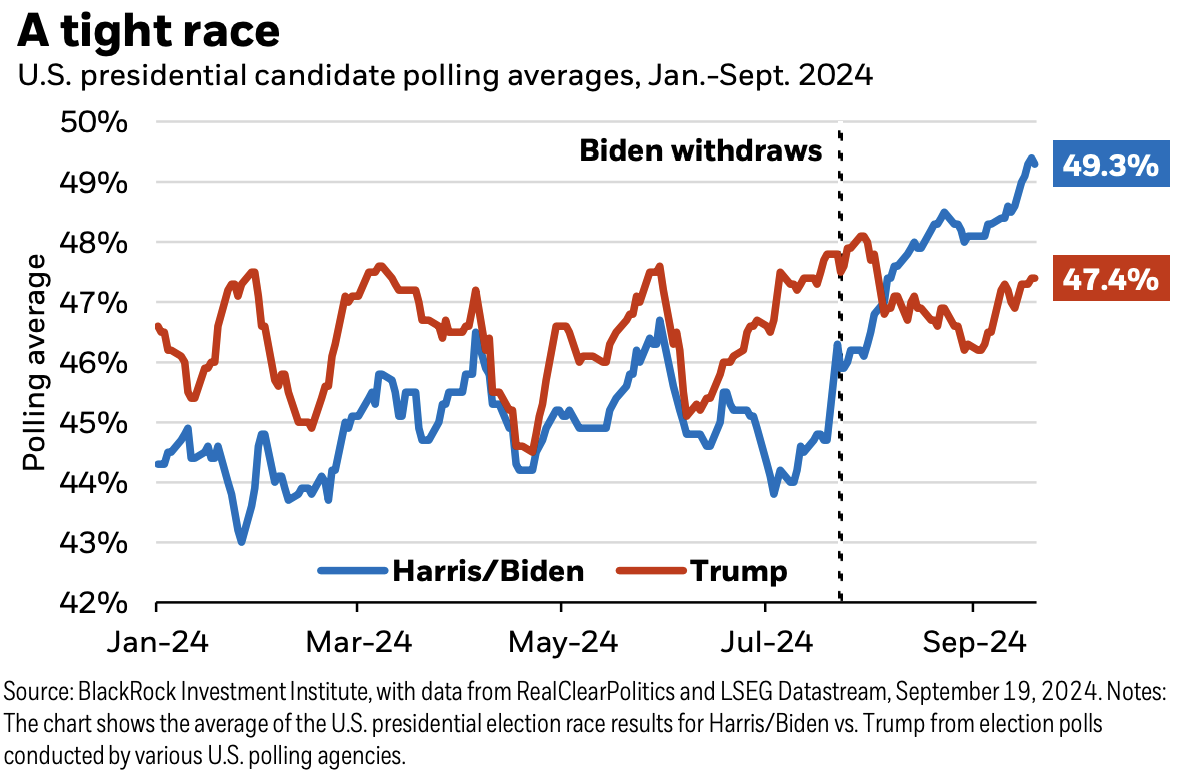

The US presidential election could impact this conflict and others (such as Russia’s invasion of Ukraine), with both candidates having different views on how the US should approach foreign affairs. Harris and Trump had their first debate, with the former coming out ahead, although the race remains too tight to call. She has a slim margin in the polls, and it looks to be a few key swing states that will decide the election. Her poll lead in some of these states is one percentage point or lower, well below the three-point lead a candidate would want to have to ensure a likelihood of victory due to the margin of error in poll results. So far, markets have been fairly agnostic on who the winner may be. Historically, markets in the US tend to fall between Labor Day and Election Day before rising again between the election and the inauguration.

Inflation in the eurozone fell to 2.2% in August, its lowest for three years. The ECB made its second interest rate cut since June, lowering the base rate by a further 25bps to 3.5%.

The Bank of England held interest rates at 5% whilst inflation remained unchanged in August from July at 2.2%. The pound reached its strongest level against the US dollar since March 2022.

The Bank of Japan left interest rates unchanged at 0.25%, with the governor indicating they won’t lift rates again until December at the earliest.